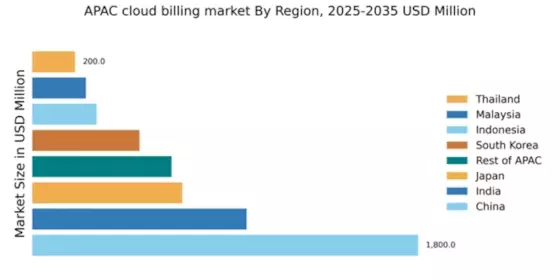

China : Unmatched Growth and Innovation

China holds a commanding market share of 36% in the APAC cloud billing sector, valued at $1800.0 million. Key growth drivers include rapid digital transformation, increased adoption of cloud services by enterprises, and supportive government policies promoting technology innovation. The demand for cloud billing solutions is driven by the rise of e-commerce and the need for efficient billing systems. Regulatory frameworks are evolving to support data security and privacy, enhancing consumer trust in cloud services. Infrastructure development, particularly in tier-1 cities, is also a significant factor in market growth.

India : Innovation and Investment Surge

India's cloud billing market is valued at $1000.0 million, capturing 20% of the APAC market. The growth is fueled by increasing internet penetration, a burgeoning startup ecosystem, and government initiatives like Digital India. Demand for cloud solutions is rising across sectors such as fintech and e-commerce, driven by the need for scalable and cost-effective billing solutions. Regulatory support for data localization and cybersecurity is also shaping the market landscape, encouraging local cloud service adoption.

Japan : Focus on Security and Compliance

Japan's cloud billing market is valued at $700.0 million, representing 14% of the APAC market. The growth is driven by the increasing need for secure and compliant cloud solutions, particularly in finance and healthcare sectors. Demand trends indicate a shift towards hybrid cloud models, as businesses seek flexibility and control over their data. Government regulations emphasize data protection and privacy, influencing cloud service adoption and infrastructure investments.

South Korea : Strong Infrastructure and Adoption

South Korea's cloud billing market is valued at $500.0 million, accounting for 10% of the APAC market. The growth is propelled by high internet penetration and a tech-savvy population. Key drivers include the rise of smart cities and IoT applications, which demand efficient billing solutions. The government is actively promoting cloud adoption through initiatives like the Cloud First Policy, enhancing the business environment for cloud service providers.

Malaysia : Government Support and Growth

Malaysia's cloud billing market is valued at $250.0 million, capturing 5% of the APAC market. The growth is driven by government initiatives such as the Malaysia Digital Economy Blueprint, which aims to enhance digital infrastructure. Demand for cloud services is increasing in sectors like education and healthcare, where efficient billing systems are essential. Regulatory frameworks are evolving to support data protection, fostering a conducive environment for cloud adoption.

Thailand : Digital Transformation in Progress

Thailand's cloud billing market is valued at $200.0 million, representing 4% of the APAC market. The growth is driven by increasing digitalization across various sectors, including tourism and retail. Government initiatives like the Thailand 4.0 policy are promoting technology adoption, enhancing the demand for cloud solutions. Regulatory support for data privacy and security is also shaping the market landscape, encouraging local businesses to adopt cloud billing systems.

Indonesia : Diverse Market Opportunities

Indonesia's cloud billing market is valued at $300.0 million, accounting for 6% of the APAC market. The growth is driven by a young, tech-savvy population and increasing smartphone penetration. Demand for cloud services is rising in sectors like e-commerce and logistics, where efficient billing solutions are crucial. Government initiatives aimed at improving digital infrastructure are also fostering a favorable environment for cloud service providers.

Rest of APAC : Varied Market Dynamics

The Rest of APAC cloud billing market is valued at $650.0 million, representing 13% of the overall APAC market. Growth is driven by varying levels of digital adoption across countries, with emerging markets showing significant potential. Demand trends indicate a shift towards localized cloud solutions, influenced by regulatory requirements. The competitive landscape includes both global and local players, each adapting to unique market conditions and consumer needs.