Rising Mobile Data Traffic

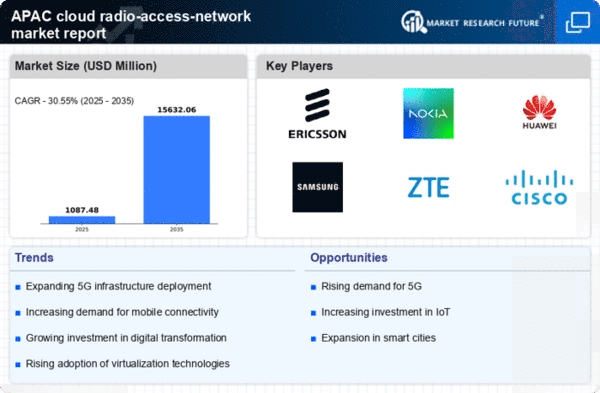

The cloud radio-access-network in APAC is experiencing a surge in mobile data traffic, driven by the increasing number of smartphone users and the proliferation of data-intensive applications. As of 2025, mobile data traffic in the region is projected to grow at a CAGR of approximately 30%, necessitating advanced network solutions. This growth compels telecom operators to adopt cloud radio-access-network technologies to enhance capacity and improve user experience. The shift towards 5G networks further amplifies this demand, as higher data rates and lower latency become essential for applications such as IoT and augmented reality. Consequently, the cloud radio-access-network in APAC is likely to expand significantly, as service providers seek to optimize their infrastructure to accommodate this rising traffic.

Cost Efficiency and Operational Flexibility

Cost efficiency remains a pivotal driver for the cloud radio-access-network market in APAC. By leveraging cloud-based solutions, telecom operators can reduce capital expenditures associated with traditional network infrastructure. The operational flexibility offered by cloud radio-access-network technologies allows for dynamic resource allocation, enabling providers to scale their services according to demand fluctuations. Reports indicate that operators can achieve up to 40% reduction in operational costs by transitioning to cloud-based architectures. This financial incentive is particularly appealing in a competitive market where profit margins are under pressure. As a result, the cloud radio-access-network market in APAC is likely to witness increased adoption as operators seek to enhance their financial performance while maintaining service quality.

Growing Demand for Enhanced User Experience

The cloud radio-access-network market in APAC is significantly influenced by the growing demand for enhanced user experience. Consumers increasingly expect seamless connectivity and high-quality service, particularly in urban areas where mobile usage is concentrated. As competition intensifies among service providers, the need to deliver superior user experiences becomes paramount. Cloud radio-access-network technologies enable operators to optimize their networks, reduce latency, and improve overall service quality. Market analysis indicates that operators who invest in these technologies can achieve customer satisfaction rates exceeding 85%. This focus on user experience is likely to drive further investments in cloud radio-access-network solutions across APAC, as providers strive to differentiate themselves in a crowded marketplace.

Regulatory Support for Network Modernization

Regulatory support is emerging as a significant driver for the cloud radio-access-network market in APAC. Governments in the region are increasingly recognizing the importance of modernizing telecommunications infrastructure to support economic growth and digital transformation. Initiatives aimed at promoting 5G deployment and enhancing broadband access are encouraging operators to invest in cloud radio-access-network technologies. For instance, regulatory frameworks that facilitate spectrum allocation and provide funding for infrastructure development are likely to accelerate the adoption of cloud radio-access-network solutions. As of 2025, it is anticipated that such supportive policies will contribute to a more robust cloud radio-access-network market in APAC, fostering innovation and competition among service providers.

Technological Advancements in Network Infrastructure

Technological advancements play a crucial role in shaping the cloud radio-access-network market in APAC. Innovations in software-defined networking (SDN) and network function virtualization (NFV) are enabling more efficient and agile network management. These technologies facilitate the deployment of cloud radio-access-network solutions, allowing operators to optimize their networks for better performance and reliability. As of 2025, the integration of AI and machine learning into network operations is expected to enhance predictive maintenance and resource management, further driving the adoption of cloud radio-access-network technologies. The continuous evolution of these technologies suggests that the cloud radio-access-network market in APAC will remain dynamic, with operators keen to leverage the latest advancements to improve service delivery.