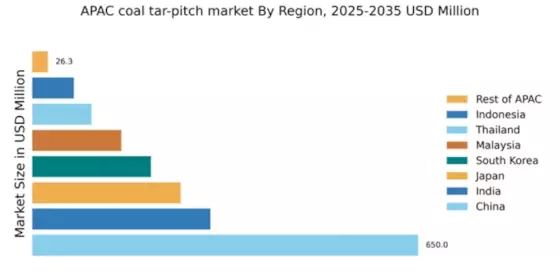

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 65% in the APAC coal tar-pitch market, valued at $650.0 million. Key growth drivers include rapid industrialization, increasing demand from the aluminum and graphite industries, and supportive government policies promoting clean energy. The Chinese government has implemented regulations to enhance production efficiency and environmental sustainability, fostering a robust infrastructure for coal tar-pitch production and consumption.

India : Strong Demand from Diverse Industries

Key markets include Maharashtra and Gujarat, where major players like Rain Industries Limited and Himadri Speciality Chemical Ltd operate. The competitive landscape is characterized by a mix of domestic and international firms, fostering innovation and efficiency. The local business environment is improving, with favorable policies encouraging investment in coal tar-pitch applications across various sectors.

Japan : Technological Advancements Drive Growth

Key markets include Tokyo and Osaka, where major players like Mitsubishi Chemical Corporation and Daihatsu Yoko Co Ltd are prominent. The competitive landscape is marked by a focus on innovation, with companies investing in R&D to develop high-performance products. The business environment is stable, supported by stringent quality regulations and a strong emphasis on environmental sustainability.

South Korea : Strategic Investments Fuel Market Expansion

Key markets include Seoul and Busan, where major players like Koppers Holdings Inc and local firms are actively competing. The competitive landscape is dynamic, with a mix of established companies and startups driving innovation. The local business environment is favorable, with government support for research and development in coal tar-pitch applications across various industries.

Malaysia : Strategic Location for Market Access

Key markets include Kuala Lumpur and Penang, where local players are establishing a strong presence. The competitive landscape features both domestic and international firms, fostering a collaborative environment. The local business environment is improving, with government policies encouraging investment in coal tar-pitch applications, particularly in construction and energy sectors.

Thailand : Diversified Applications Drive Growth

Key markets include Bangkok and Chonburi, where local players are gaining traction. The competitive landscape is characterized by a mix of established companies and new entrants, fostering innovation. The local business environment is evolving, with government support for coal tar-pitch applications in various industries, particularly in construction and energy.

Indonesia : Rising Demand in Key Sectors

Key markets include Jakarta and Surabaya, where local players are establishing a foothold. The competitive landscape is evolving, with both domestic and international firms vying for market share. The local business environment is improving, with government policies encouraging investment in coal tar-pitch applications across various sectors, particularly in construction and energy.

Rest of APAC : Diverse Applications Across Regions

Key markets include emerging economies in Southeast Asia and the Pacific Islands, where local players are beginning to establish a presence. The competitive landscape is diverse, with a mix of small and medium enterprises driving innovation. The local business environment is evolving, with government support for coal tar-pitch applications in various sectors, particularly in specialty chemicals and construction.