China : Unmatched Growth and Innovation

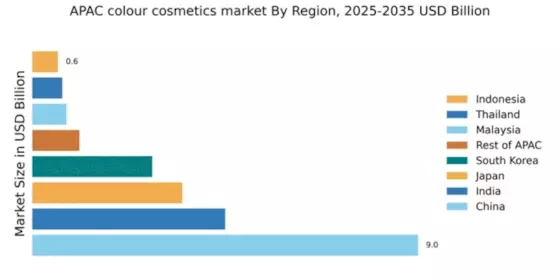

China holds a commanding 9.0% market share in the APAC colour cosmetics sector, driven by a burgeoning middle class and increasing disposable incomes. The demand for high-quality, innovative products is on the rise, with consumers gravitating towards brands that emphasize sustainability and natural ingredients. Government initiatives promoting local manufacturing and stringent regulations on product safety further bolster market growth. Infrastructure improvements in logistics and retail also enhance distribution channels.

India : Youthful Demographics Drive Demand

India's colour cosmetics market accounts for 4.5% of the APAC total, reflecting a vibrant and youthful consumer base. The rise of social media influencers and beauty bloggers has significantly shaped consumption patterns, leading to increased demand for diverse product ranges. Government policies supporting Make in India initiatives encourage local production, while urbanization and rising incomes further fuel market expansion. The retail landscape is evolving with a mix of traditional and modern trade channels.

Japan : Cultural Nuances Shape Preferences

Japan's colour cosmetics market holds a 3.5% share in APAC, characterized by a strong preference for quality and innovation. The demand for multifunctional products that cater to specific skin types is on the rise, driven by an aging population and a focus on skincare. Regulatory frameworks ensure high safety standards, while government support for R&D in cosmetics fosters innovation. The market is also influenced by seasonal trends and limited-edition product launches.

South Korea : Trends Set by Innovative Brands

South Korea commands a 2.8% market share in the APAC colour cosmetics sector, renowned for its K-beauty phenomenon. The rapid adoption of new beauty trends, such as cushion compacts and skincare-infused makeup, drives consumer interest. Government regulations promote transparency and safety in product formulations, while a robust e-commerce infrastructure facilitates access to a wide range of products. Major cities like Seoul are pivotal in shaping market dynamics.

Malaysia : Cultural Diversity Influences Choices

Malaysia's colour cosmetics market, with a 0.8% share, is experiencing steady growth fueled by its multicultural population. The demand for halal-certified products is rising, reflecting the preferences of the Muslim majority. Government initiatives to promote local brands and enhance export capabilities are pivotal. Urban centers like Kuala Lumpur are key markets, with a competitive landscape featuring both international and local players.

Thailand : Tourism Boosts Cosmetic Sales

Thailand's colour cosmetics market represents 0.7% of the APAC total, driven by a strong tourism sector and a youthful population. The demand for vibrant and trendy products is high, influenced by local beauty standards and social media. Government support for the cosmetics industry, including tax incentives for local manufacturers, enhances market growth. Bangkok serves as a central hub for both retail and distribution, attracting major global brands.

Indonesia : Youthful Consumers Drive Growth

Indonesia's colour cosmetics market, accounting for 0.6% of APAC, is on the rise, driven by a young and increasingly urbanized population. The demand for affordable yet quality products is growing, with local brands gaining traction. Government initiatives to support small and medium enterprises in the cosmetics sector are crucial. Key cities like Jakarta and Surabaya are central to market dynamics, with a competitive landscape featuring both local and international players.

Rest of APAC : Regional Differences Shape Demand

The Rest of APAC holds a 1.1% share in the colour cosmetics market, characterized by diverse consumer preferences across different countries. Emerging markets are witnessing growth driven by increasing urbanization and changing beauty standards. Government policies vary significantly, impacting market entry strategies for international brands. Local players are gaining ground, particularly in countries like Vietnam and the Philippines, where traditional beauty practices influence product offerings.