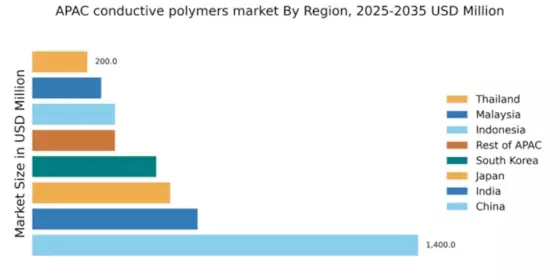

China : Unmatched Growth and Innovation

China holds a commanding market share of 46.67% in the conductive polymers sector, valued at $1400.0 million. Key growth drivers include rapid industrialization, increasing demand for electronics, and government initiatives promoting advanced materials. The consumption pattern is shifting towards eco-friendly and high-performance polymers, supported by regulatory policies aimed at sustainability. Infrastructure development, particularly in urban areas, is enhancing production capabilities and supply chain efficiency.

India : Rapid Growth in Electronics Sector

India accounts for 20% of the APAC conductive polymers market, valued at $600.0 million. The growth is driven by the booming electronics and automotive sectors, alongside government initiatives like 'Make in India' that encourage local manufacturing. Demand for conductive polymers is rising in applications such as flexible displays and sensors, supported by favorable regulatory frameworks. The increasing focus on renewable energy is also propelling market growth.

Japan : Innovation and Quality at Forefront

Japan holds a market share of 16.67%, valued at $500.0 million, driven by its advanced technology and high-quality manufacturing standards. The demand for conductive polymers is primarily fueled by the electronics and automotive industries, with a strong emphasis on R&D. Government policies promoting innovation and sustainability are enhancing market dynamics. The country’s robust infrastructure supports efficient production and distribution channels.

South Korea : Innovation-Driven Market Dynamics

South Korea represents 15% of the market, valued at $450.0 million. The growth is propelled by the electronics sector, particularly in semiconductors and displays. Government initiatives supporting research in advanced materials and sustainability are key growth drivers. The competitive landscape features major players like LG Chem and DuPont, with a focus on high-performance applications. Cities like Seoul and Busan are central to market activities.

Malaysia : Strategic Location and Development

Malaysia captures 8.33% of the market, valued at $250.0 million. The growth is driven by increasing demand in the electronics and automotive sectors, supported by government initiatives to attract foreign investment. The consumption of conductive polymers is rising in applications like packaging and coatings. The competitive landscape includes local and international players, with Kuala Lumpur being a key market hub.

Thailand : Strategic Growth in Electronics

Thailand holds a market share of 6.67%, valued at $200.0 million. The growth is driven by the automotive and electronics industries, with increasing demand for conductive polymers in various applications. Government policies promoting investment in high-tech industries are enhancing market conditions. The competitive landscape features both local and international players, with Bangkok being a significant market area.

Indonesia : Growth in Industrial Applications

Indonesia accounts for 10% of the market, valued at $300.0 million. The growth is driven by increasing industrialization and demand for electronics. Government initiatives aimed at boosting manufacturing capabilities are key growth drivers. The competitive landscape includes both local and international players, with Jakarta being a central market. Applications in renewable energy and automotive sectors are gaining traction.

Rest of APAC : Varied Applications Across Regions

The Rest of APAC holds a market share of 10% at $300.0 million. The growth is driven by diverse applications in electronics, automotive, and renewable energy sectors. Each country has unique regulatory frameworks and market dynamics, influencing consumption patterns. The competitive landscape features a mix of local and international players, with key markets spread across various cities. The focus on sustainability is shaping future demand.