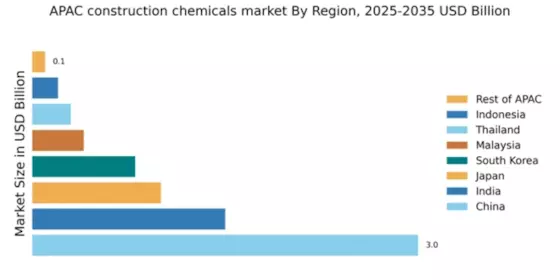

China : Rapid Growth and Urbanization Drive Demand

Key markets include major cities like Beijing, Shanghai, and Shenzhen, where construction activities are booming. The competitive landscape features significant players such as BASF, Sika, and Fosroc, all vying for market share. Local dynamics are influenced by a growing preference for innovative solutions in construction, particularly in high-rise buildings and infrastructure projects. The demand for specialized applications, such as waterproofing and concrete additives, is on the rise.

India : Infrastructure Push Fuels Growth Opportunities

Key markets include metropolitan areas such as Mumbai, Delhi, and Bengaluru, where construction activities are robust. The competitive landscape features major players like Sika and Mapei, alongside local firms. The business environment is characterized by a mix of traditional practices and modern techniques, with a growing emphasis on quality and performance. Applications in residential, commercial, and industrial sectors are expanding, particularly in waterproofing and repair solutions.

Japan : Technological Advancements Drive Demand

Key markets include Tokyo and Osaka, where construction activities are concentrated. The competitive landscape is dominated by established players like BASF and Henkel, known for their innovative solutions. Local dynamics favor high-quality products, with a strong emphasis on R&D. The market is witnessing increased applications in infrastructure, particularly in seismic retrofitting and high-performance coatings, catering to the unique challenges posed by Japan's geography.

South Korea : Infrastructure Development Drives Demand

Key markets include Seoul and Busan, where construction activities are vibrant. The competitive landscape features major players like Sika and GCP Applied Technologies, competing for market share. Local dynamics are influenced by a strong emphasis on quality and innovation, with increasing applications in residential and commercial sectors. The demand for specialized products, such as adhesives and sealants, is on the rise, reflecting evolving construction practices.

Malaysia : Infrastructure Projects Boost Demand

Key markets include Kuala Lumpur and Penang, where construction activities are concentrated. The competitive landscape features players like BASF and Mapei, alongside local firms. The business environment is characterized by a mix of traditional and modern construction practices, with increasing applications in residential, commercial, and industrial sectors. The demand for specialized products, such as concrete admixtures and waterproofing solutions, is on the rise.

Thailand : Infrastructure Development Drives Demand

Key markets include Bangkok and Chiang Mai, where construction activities are robust. The competitive landscape features major players like Sika and Fosroc, competing for market share. Local dynamics favor innovative solutions, with increasing applications in residential and commercial sectors. The demand for specialized products, such as repair mortars and adhesives, is on the rise, reflecting evolving construction practices.

Indonesia : Infrastructure Development Fuels Growth

Key markets include Jakarta and Surabaya, where construction activities are concentrated. The competitive landscape features players like BASF and GCP Applied Technologies, alongside local firms. The business environment is characterized by a mix of traditional practices and modern techniques, with increasing applications in residential and commercial sectors. The demand for specialized products, such as concrete additives and sealants, is on the rise, reflecting evolving construction practices.

Rest of APAC : Diverse Applications Across Regions

Key markets include emerging economies in Southeast Asia and the Pacific Islands, where construction activities are growing. The competitive landscape features a mix of local and international players, each adapting to regional dynamics. Local market conditions favor innovative solutions, with applications in residential, commercial, and industrial sectors. The demand for specialized products, such as repair and maintenance solutions, is on the rise, reflecting the diverse needs of these markets.