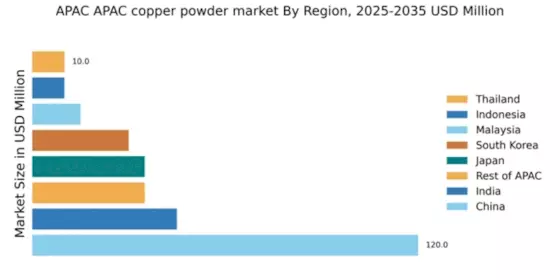

China : Unmatched Demand and Production Capacity

China holds a commanding 120.0 market share in the APAC copper powder market, driven by robust industrial growth and increasing demand in electronics and automotive sectors. Key growth drivers include government initiatives promoting electric vehicles and renewable energy technologies, alongside significant investments in infrastructure. Regulatory policies favoring sustainable practices further enhance market dynamics, while the country's extensive manufacturing capabilities ensure a steady supply of copper powder.

India : Rapid Industrialization Fuels Growth

India accounts for a 45.0 market share in the copper powder sector, with growth fueled by rapid industrialization and urbanization. The demand for copper powder is rising in sectors like construction, electronics, and renewable energy. Government initiatives such as 'Make in India' and investments in smart city projects are pivotal in driving consumption patterns. Regulatory frameworks are evolving to support sustainable practices, enhancing the overall market environment.

Japan : Innovation Drives Market Dynamics

Japan's copper powder market holds a 35.0 share, characterized by advanced technology and high-quality production standards. The growth is propelled by demand in electronics, automotive, and aerospace industries, where precision and quality are paramount. Government policies promoting innovation and sustainability are crucial, alongside a strong focus on R&D in materials science. The market is supported by a well-established infrastructure and a skilled workforce.

South Korea : Key Player in High-Tech Applications

With a 30.0 market share, South Korea's copper powder market is significantly influenced by its robust electronics and semiconductor industries. The demand is driven by advancements in technology and the increasing use of copper in electric vehicles and renewable energy systems. Government initiatives supporting innovation and technology development play a vital role. The competitive landscape features major players like LG and Samsung, enhancing market dynamics.

Malaysia : Investment in Infrastructure Boosts Demand

Malaysia's copper powder market, with a 15.0 share, is experiencing growth due to strategic investments in infrastructure and manufacturing. The demand is primarily driven by the construction and electronics sectors, supported by government initiatives aimed at enhancing industrial capabilities. Regulatory policies are increasingly focused on sustainability, promoting eco-friendly practices. The market is characterized by a competitive landscape with local and international players.

Thailand : Diverse Industries Fuel Market Growth

Thailand holds a 10.0 market share in the copper powder market, driven by diverse applications across automotive, electronics, and construction sectors. The growth is supported by government policies encouraging foreign investment and industrial development. Key cities like Bangkok and Chonburi are central to market activities, with a competitive landscape featuring both local and international players. The business environment is evolving, fostering innovation and sustainability.

Indonesia : Natural Resources Drive Market Opportunities

Indonesia's copper powder market, also at 10.0 share, is poised for growth due to its rich natural resources and increasing industrial activities. The demand is driven by sectors such as construction and electronics, with government initiatives aimed at boosting local manufacturing capabilities. The competitive landscape includes both domestic and international players, with key markets in Jakarta and Surabaya. Regulatory frameworks are adapting to support sustainable practices.

Rest of APAC : Varied Demand Across Sub-Regions

The Rest of APAC accounts for a 35.0 market share in copper powder, characterized by diverse demand across various industries. Growth drivers include increasing industrialization and urbanization in emerging markets. Regulatory policies vary significantly, impacting market dynamics differently across countries. The competitive landscape features a mix of local and international players, with applications spanning construction, electronics, and automotive sectors.