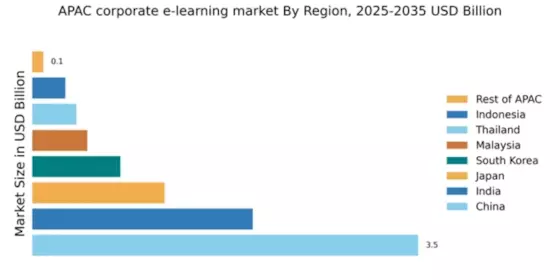

China : Rapid Growth and Innovation

China holds a commanding 3.5% market share in the APAC corporate e-learning sector, driven by a burgeoning demand for digital skills and government initiatives promoting online education. The increasing adoption of technology in education, coupled with a strong push for workforce upskilling, has led to a significant rise in consumption patterns. Regulatory support, such as the Ministry of Education's policies on online learning, further enhances infrastructure development, making e-learning more accessible across urban and rural areas.

India : Diverse Needs and Opportunities

India's corporate e-learning market is valued at 2.0%, reflecting a rapid shift towards online education driven by a young workforce eager for skill enhancement. The demand for localized content and mobile learning solutions is on the rise, supported by government initiatives like Digital India. The increasing internet penetration and smartphone usage are pivotal in shaping consumption patterns, while regulatory frameworks encourage private sector participation in e-learning.

Japan : Focus on Quality and Innovation

Japan's corporate e-learning market accounts for 1.2%, characterized by a strong emphasis on quality and technological integration. The demand for advanced learning solutions is driven by the need for continuous professional development in a competitive job market. Government policies promoting lifelong learning and digital transformation in education are key growth drivers, alongside a robust infrastructure that supports high-speed internet access across urban centers.

South Korea : Integration of AI and Gamification

South Korea's market share stands at 0.8%, with a vibrant e-learning ecosystem fueled by technological advancements. The integration of AI and gamification in learning platforms is reshaping consumption patterns, appealing to a tech-savvy workforce. Government initiatives, such as the Korean Ministry of Education's support for digital learning, enhance infrastructure and accessibility, fostering a competitive environment for local and international players.

Malaysia : Focus on Workforce Development

Malaysia's corporate e-learning market is valued at 0.5%, driven by a growing emphasis on workforce development and skill enhancement. The government's initiatives, such as the National Digital Economy and Fourth Industrial Revolution (4IR) policy, promote digital learning solutions. Urban centers like Kuala Lumpur and Penang are key markets, with increasing internet penetration and mobile device usage shaping consumption trends in the corporate sector.

Thailand : Cultural Shift Towards Digital Learning

Thailand's market share is 0.4%, reflecting a cultural shift towards digital learning solutions. The demand for e-learning is driven by the need for upskilling in various industries, supported by government policies promoting education technology. Key cities like Bangkok and Chiang Mai are witnessing increased adoption of online learning platforms, with local players emerging alongside international competitors to cater to diverse learning needs.

Indonesia : Youthful Population Driving Growth

Indonesia's corporate e-learning market is valued at 0.3%, with a youthful population driving demand for online education. The government's focus on improving digital literacy and access to technology is pivotal in shaping consumption patterns. Key urban areas like Jakarta and Surabaya are central to market growth, with local and international players competing to offer tailored e-learning solutions that meet the needs of diverse industries.

Rest of APAC : Diverse Needs Across Regions

The Rest of APAC holds a modest market share of 0.1%, with niche markets emerging in various countries. Demand for e-learning solutions is influenced by local cultural and economic factors, with governments increasingly recognizing the importance of digital education. Regulatory frameworks are evolving to support the growth of e-learning, creating opportunities for both local and international players to enter these diverse markets.