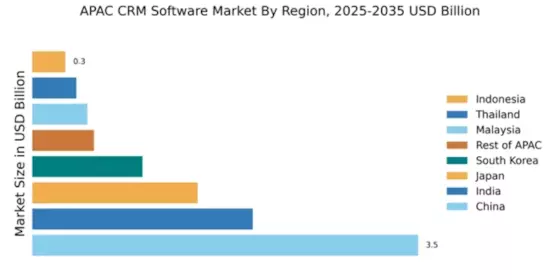

China : Rapid Growth and Innovation Drive Market

China holds a commanding 3.5% market share in the APAC CRM software sector, valued at approximately $1.5 billion. Key growth drivers include a booming e-commerce sector, increasing digital transformation initiatives, and supportive government policies promoting technology adoption. Demand trends show a shift towards cloud-based solutions, with businesses seeking integrated platforms to enhance customer engagement. The government has implemented favorable regulations to encourage tech investments, bolstering infrastructure development in major cities like Beijing and Shanghai.

India : Digital Transformation Fuels Market Growth

India's CRM software market is valued at 2.0%, approximately $800 million, driven by rapid digitalization across sectors. The rise of SMEs and startups, coupled with increasing internet penetration, has led to heightened demand for CRM solutions. Government initiatives like Digital India are promoting technology adoption, while regulatory frameworks are evolving to support data privacy and security. The market is characterized by a growing preference for affordable, scalable solutions tailored to local needs.

Japan : Technology-Driven Market Dynamics

Japan's CRM market holds a 1.5% share, valued at around $600 million, with growth fueled by advanced technology adoption and a focus on customer experience. The demand for AI-driven analytics and automation tools is rising, as businesses seek to enhance customer interactions. Regulatory policies emphasize data protection, influencing CRM software features. The market is supported by a robust infrastructure, particularly in urban centers like Tokyo and Osaka, where tech-savvy consumers drive demand.

South Korea : Strong Demand for Custom Solutions

South Korea's CRM software market accounts for 1.0%, approximately $400 million, with growth driven by a competitive business environment and high consumer expectations. The demand for customized CRM solutions is increasing, particularly in sectors like retail and finance. Government initiatives support innovation and technology adoption, while regulatory frameworks ensure data security. Key cities like Seoul and Busan are central to market activities, with major players like Salesforce and SAP establishing strong footholds.

Malaysia : SMEs Drive Market Expansion

Malaysia's CRM market is valued at 0.5%, around $200 million, with significant growth driven by the increasing number of SMEs seeking digital solutions. Government initiatives like the Malaysia Digital Economy Corporation are fostering technology adoption, while regulatory policies support data protection. Demand trends indicate a shift towards cloud-based CRM systems, enhancing accessibility for businesses. Key markets include Kuala Lumpur and Penang, where local players are emerging alongside global giants.

Thailand : Digital Shift Enhances Market Potential

Thailand's CRM software market holds a 0.4% share, valued at approximately $160 million, with growth driven by digital transformation across various sectors. The government is promoting technology adoption through initiatives like Thailand 4.0, encouraging businesses to invest in CRM solutions. Demand is rising for mobile-friendly platforms, reflecting changing consumer behaviors. Key cities such as Bangkok and Chiang Mai are pivotal, with both local and international players competing for market share.

Indonesia : Rapid Growth in Digital Solutions

Indonesia's CRM market is valued at 0.3%, approximately $120 million, with growth driven by a young, tech-savvy population and increasing internet penetration. Government initiatives are promoting digital transformation, while regulatory frameworks are evolving to support data privacy. Demand for affordable, scalable CRM solutions is rising, particularly among SMEs. Key markets include Jakarta and Surabaya, where local startups are gaining traction alongside established global players.

Rest of APAC : Varied Growth Across Sub-Regions

The Rest of APAC CRM market holds a 0.56% share, valued at around $220 million, with diverse growth driven by varying levels of digital adoption. Countries like Vietnam and the Philippines are witnessing increased demand for CRM solutions as businesses seek to enhance customer engagement. Government initiatives are supporting technology adoption, while regulatory frameworks are adapting to new market dynamics. The competitive landscape features both local and international players, catering to unique regional needs.