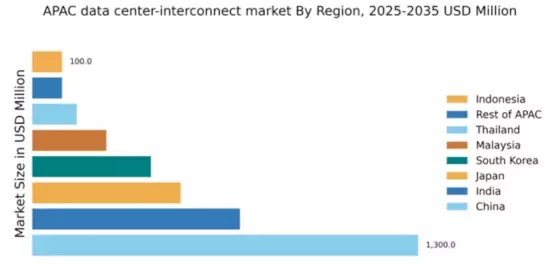

China : Unmatched Growth and Investment

China holds a commanding market share of 43% in the APAC data center-interconnect market, valued at $1,300.0 million. Key growth drivers include rapid digital transformation, increasing cloud adoption, and government initiatives promoting technology infrastructure. The demand for data centers is surging, fueled by e-commerce and AI applications. Regulatory policies favoring foreign investment and local partnerships further enhance market potential, while significant infrastructure development supports this growth.

India : Cloud Adoption Fuels Growth

India's data center-interconnect market is valued at $700.0 million, capturing 22% of the APAC market. The growth is driven by increasing internet penetration, a booming startup ecosystem, and government initiatives like Digital India. Demand is particularly high in urban areas, with consumption patterns shifting towards hybrid cloud solutions. Regulatory support and investment in renewable energy are also pivotal in shaping the market landscape.

Japan : Innovation and Reliability at Core

Japan's market share stands at 15% with a value of $500.0 million. The growth is propelled by the country's focus on innovation, particularly in IoT and AI technologies. Demand trends indicate a shift towards high-performance computing and edge data centers. Government policies promoting cybersecurity and data privacy are crucial, alongside robust infrastructure development in urban centers like Tokyo and Osaka.

South Korea : Strategic Location for Connectivity

South Korea holds a 12% market share, valued at $400.0 million. The growth is driven by the country's advanced telecommunications infrastructure and high internet penetration. Demand is increasing for data center services, particularly in Seoul and Busan, as businesses migrate to cloud solutions. The competitive landscape features major players like NTT and local firms, supported by government initiatives to enhance digital infrastructure.

Malaysia : Strategic Growth in Southeast Asia

Malaysia's data center-interconnect market is valued at $250.0 million, representing 8% of the APAC market. The growth is fueled by increasing foreign investments and government initiatives like the Malaysia Digital Economy Blueprint. Demand is rising in key cities such as Kuala Lumpur and Penang, with a focus on green data centers. The competitive landscape includes both local and international players, enhancing market dynamics.

Thailand : Investment in Connectivity Solutions

Thailand's market is valued at $150.0 million, capturing 5% of the APAC market. The growth is driven by increasing digitalization and government support for technology initiatives. Demand trends show a rise in cloud services, particularly in Bangkok and Chiang Mai. The competitive landscape features local firms and international players, with a focus on enhancing connectivity and infrastructure development.

Indonesia : Rising Demand for Data Services

Indonesia's data center-interconnect market is valued at $100.0 million, representing 3% of the APAC market. The growth is driven by increasing internet usage and a burgeoning digital economy. Demand is particularly strong in Jakarta and Surabaya, with a focus on cloud services and data security. The competitive landscape is evolving, with both local and international players entering the market to capitalize on growth opportunities.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC market is valued at $100.0 million, accounting for 3% of the overall market. Growth is driven by varying levels of digital transformation across countries. Demand trends indicate a focus on localized data services and cloud solutions. The competitive landscape is diverse, with regional players adapting to local market needs and regulatory environments, enhancing overall market dynamics.