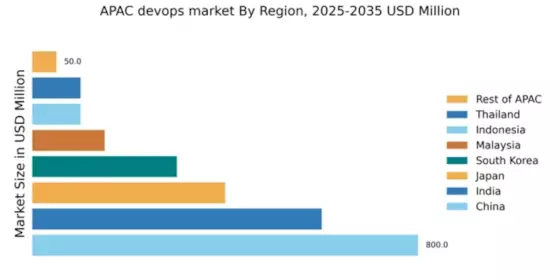

China : Rapid Growth and Innovation Hub

Key markets include major cities like Beijing, Shanghai, and Shenzhen, which are tech innovation centers. The competitive landscape features strong players like Alibaba Cloud, Tencent, and Huawei, alongside global giants like Microsoft and Amazon. Local market dynamics are characterized by a fast-paced business environment, with a focus on sectors such as e-commerce, finance, and manufacturing. The demand for DevOps solutions is particularly high in software development and IT services, driving further growth in the region.

India : Innovation and Talent Pool Growth

Key markets include Bengaluru, Hyderabad, and Pune, known for their tech ecosystems. The competitive landscape is vibrant, with local players like Zoho and The devops market share. The business environment is conducive to innovation, with a focus on sectors such as fintech, e-commerce, and healthcare. The demand for DevOps is particularly strong in software development and IT services, driving further investment in the region.

Japan : Precision and Quality in DevOps

Key markets include Tokyo, Osaka, and Nagoya, which are hubs for technology and innovation. The competitive landscape features major players like Fujitsu, NEC, and global firms like Microsoft and Amazon. The local business environment is characterized by a focus on precision and quality, with significant applications in sectors such as automotive, manufacturing, and finance. The demand for DevOps solutions is particularly strong in software development and IT services, driving further growth in the region.

South Korea : Innovation and Technology Integration

Key markets include Seoul, Busan, and Incheon, which are centers for technology and innovation. The competitive landscape features local players like Naver and Kakao, alongside global firms like IBM and Google. The business environment is dynamic, with a focus on sectors such as gaming, finance, and telecommunications. The demand for DevOps solutions is particularly strong in software development and IT services, driving further investment in the region.

Malaysia : Strategic Location and Talent Development

Key markets include Kuala Lumpur, Penang, and Cyberjaya, which are emerging tech hubs. The competitive landscape features local players like Fusionex and global firms like Microsoft and Amazon. The business environment is supportive of innovation, with a focus on sectors such as e-commerce, finance, and logistics. The demand for DevOps solutions is particularly strong in software development and IT services, driving further growth in the region.

Thailand : Digital Transformation and Growth Potential

Key markets include Bangkok, Chiang Mai, and Pattaya, which are emerging tech hubs. The competitive landscape features local players like Advanced Info Service and global firms like IBM and Google. The business environment is evolving, with a focus on sectors such as e-commerce, finance, and tourism. The demand for DevOps solutions is particularly strong in software development and IT services, driving further investment in the region.

Indonesia : Rapid Growth and Digital Adoption

Key markets include Jakarta, Bandung, and Surabaya, which are centers for technology and innovation. The competitive landscape features local players like Gojek and global firms like Microsoft and Amazon. The business environment is dynamic, with a focus on sectors such as e-commerce, finance, and logistics. The demand for DevOps solutions is particularly strong in software development and IT services, driving further growth in the region.

Rest of APAC : Diverse Markets and Unique Challenges

Key markets include emerging tech hubs in countries like Vietnam, Philippines, and Singapore. The competitive landscape features a mix of local startups and global players like IBM and Google. The business environment is diverse, with varying levels of digital maturity across countries. The demand for DevOps solutions is particularly strong in sectors such as e-commerce, finance, and healthcare, driving further investment in the region.