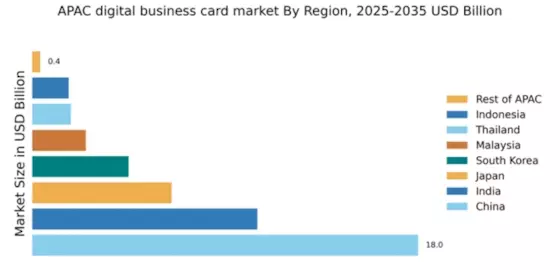

China : Rapid Growth and Innovation Hub

China holds a commanding 18.0% market share in the digital business card sector, driven by a booming tech ecosystem and increasing smartphone penetration. The demand for digital solutions is fueled by the rise of remote work and networking needs, supported by government initiatives promoting digital transformation. Regulatory policies favoring tech innovation and investment in infrastructure further bolster market growth, making it a vibrant landscape for digital business cards.

India : Youthful Demographics Driving Adoption

India's digital business card market accounts for 10.5%, reflecting a growing trend among its youthful population. The surge in entrepreneurship and the gig economy are key growth drivers, with increasing demand for efficient networking tools. Government initiatives like Digital India are enhancing digital literacy and infrastructure, paving the way for broader adoption of digital solutions across various sectors.

Japan : Blending Tradition with Innovation

Japan's market share stands at 6.5%, characterized by a unique blend of traditional business practices and modern technology. The demand for digital business cards is rising, particularly among startups and tech firms. Government support for digital innovation and a strong emphasis on efficiency in business operations are key growth factors, alongside a robust infrastructure that facilitates tech adoption.

South Korea : Strong Tech Adoption and Trends

South Korea holds a 4.5% market share in the digital business card market, driven by high smartphone usage and a tech-savvy population. The demand for innovative networking solutions is growing, supported by government policies promoting digital transformation. Major cities like Seoul are at the forefront, with a competitive landscape featuring both local and international players.

Malaysia : Government Support Fuels Growth

Malaysia's digital business card market represents 2.5%, with growth driven by increasing digital literacy and government initiatives like the Malaysia Digital Economy Corporation. The demand for digital solutions is rising among SMEs and startups, supported by improving infrastructure and connectivity. The market is characterized by a mix of local and international players, enhancing competition.

Thailand : Youthful Workforce Embraces Digital

Thailand's market share is 1.8%, with a growing interest in digital business cards among young professionals and entrepreneurs. The demand is fueled by the rise of remote work and networking needs, supported by government initiatives aimed at enhancing digital skills. Key urban centers like Bangkok are pivotal in driving market growth, with a competitive landscape featuring both local and international solutions.

Indonesia : Digital Transformation on the Rise

Indonesia's digital business card market accounts for 1.7%, with significant growth potential driven by a large, youthful population and increasing smartphone penetration. The government is promoting digital initiatives to enhance connectivity and digital literacy. Major cities like Jakarta are key markets, with a competitive landscape that includes both local startups and international players.

Rest of APAC : Fragmented Yet Promising Opportunities

The Rest of APAC holds a modest 0.37% market share in digital business cards, characterized by diverse markets with varying levels of digital adoption. Growth is driven by localized demand and increasing awareness of digital solutions. Regulatory environments differ significantly, impacting market dynamics. Countries like Vietnam and the Philippines are emerging as potential growth areas, with a mix of local and international players.