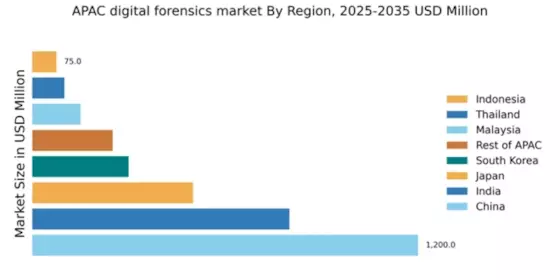

China : Robust Growth Driven by Innovation

China holds a commanding market share of 48% in the APAC digital forensics sector, valued at $1200.0 million. Key growth drivers include rapid technological advancements, increasing cybercrime rates, and government initiatives promoting digital security. The demand for digital forensics tools is surging, particularly in law enforcement and corporate sectors, supported by regulatory frameworks that emphasize data protection and cybersecurity. Infrastructure development, especially in tech hubs like Shenzhen and Beijing, further fuels market expansion.

India : Growing Demand for Cybersecurity Solutions

India accounts for 32% of the APAC digital forensics market, valued at $800.0 million. The growth is driven by increasing digitalization, rising cybercrime incidents, and a proactive government stance on cybersecurity. Demand is particularly strong in sectors like finance and telecommunications, where data integrity is paramount. Regulatory policies, such as the Personal Data Protection Bill, are shaping the landscape, encouraging investments in digital forensics capabilities.

Japan : Strong Focus on Cyber Resilience

Japan represents 20% of the APAC digital forensics market, valued at $500.0 million. The market is propelled by a strong emphasis on cybersecurity, driven by government initiatives and the increasing sophistication of cyber threats. Demand is particularly high in sectors like manufacturing and finance, where data breaches can have severe repercussions. Regulatory frameworks, including the Act on the Protection of Personal Information, are enhancing the market's growth trajectory.

South Korea : Government Support Fuels Innovation

South Korea holds a 12% share of the APAC digital forensics market, valued at $300.0 million. The growth is supported by government initiatives aimed at enhancing national cybersecurity and combating cybercrime. Key demand trends are emerging in sectors like finance and telecommunications, where data protection is critical. The competitive landscape features major players like Kroll and AccessData, with a focus on innovative solutions tailored to local needs.

Malaysia : Investment in Cybersecurity Infrastructure

Malaysia captures 6% of the APAC digital forensics market, valued at $150.0 million. The market is driven by increasing awareness of cybersecurity threats and government initiatives promoting digital safety. Demand is rising in sectors such as banking and telecommunications, where data integrity is crucial. The government’s National Cyber Security Strategy is fostering a conducive environment for digital forensics growth, supported by infrastructure investments in key cities like Kuala Lumpur.

Thailand : Focus on Cybercrime Prevention

Thailand accounts for 4% of the APAC digital forensics market, valued at $100.0 million. The growth is driven by rising cybercrime incidents and a growing emphasis on cybersecurity across various sectors. Government initiatives, such as the Cybersecurity Act, are enhancing the regulatory framework, promoting investments in digital forensics. Key markets include Bangkok and Chiang Mai, where local players are emerging to meet the growing demand for forensic solutions.

Indonesia : Rising Awareness of Cyber Threats

Indonesia holds a 3% share of the APAC digital forensics market, valued at $75.0 million. The market is experiencing growth due to increasing digitalization and awareness of cybersecurity threats. Demand is particularly strong in sectors like finance and e-commerce, where data breaches can have significant impacts. Government initiatives aimed at enhancing cybersecurity infrastructure are paving the way for digital forensics growth, especially in urban centers like Jakarta.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for 10% of the digital forensics market, valued at $250.0 million. This segment includes diverse markets with varying levels of digital forensics maturity. Growth drivers include increasing cyber threats and regulatory frameworks promoting data protection. Demand trends vary significantly, with some regions focusing on law enforcement applications while others emphasize corporate cybersecurity. The competitive landscape features both local and international players adapting to regional needs.