China : China's Leadership in Airport Technology

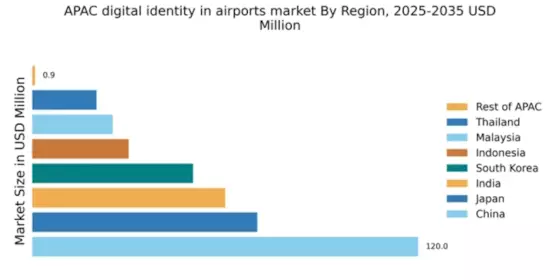

China holds a commanding market share of 120.0, representing a significant 40% of the APAC digital identity-in-airports market. Key growth drivers include rapid urbanization, increased air travel, and government initiatives aimed at enhancing airport security. The Chinese government has implemented policies to promote smart airport technologies, which are crucial for improving passenger experience and operational efficiency. Infrastructure investments in major airports like Beijing Capital and Shanghai Pudong are also pivotal in driving demand.

India : India's Growth in Airport Technology

India's digital identity-in-airports market is valued at 60.0, accounting for 20% of the APAC market. The growth is fueled by increasing passenger traffic, government initiatives like the Digital India program, and investments in airport infrastructure. Demand for biometric systems and automated processes is rising, driven by the need for enhanced security and efficiency. Regulatory support for digital transformation in aviation is also a key factor.

Japan : Japan's Technological Advancements

Japan's market share stands at 70.0, contributing 23% to the APAC digital identity sector. The growth is driven by technological innovation, with a focus on contactless solutions and biometric identification. Government policies promoting smart city initiatives and airport modernization are pivotal. The demand for seamless travel experiences is increasing, influenced by the upcoming 2025 World Expo in Osaka, which is expected to boost airport technology investments.

South Korea : South Korea's Digital Identity Focus

South Korea's digital identity-in-airports market is valued at 50.0, representing 17% of the APAC market. Key growth drivers include government initiatives for smart airport development and rising international travel. The country is investing heavily in biometric technologies and automated border control systems to enhance security and efficiency. Regulatory frameworks support the integration of advanced technologies in airports, fostering a conducive business environment.

Malaysia : Malaysia's Airport Technology Expansion

Malaysia's market is valued at 25.0, making up 8% of the APAC digital identity market. The growth is driven by increasing air travel and government initiatives to modernize airport infrastructure. Demand for biometric systems is rising, supported by regulatory policies aimed at enhancing security. The Kuala Lumpur International Airport is a key market, focusing on integrating digital identity solutions to improve passenger experience and operational efficiency.

Thailand : Thailand's Airport Innovations

Thailand's digital identity-in-airports market is valued at 20.0, accounting for 7% of the APAC market. The growth is primarily driven by the booming tourism sector and government efforts to enhance airport security. The Thai government is investing in biometric technologies and automated systems to streamline passenger processing. Key airports like Suvarnabhumi and Don Mueang are at the forefront of adopting these innovations, creating a competitive landscape.

Indonesia : Indonesia's Airport Technology Growth

Indonesia's market is valued at 30.0, representing 10% of the APAC digital identity sector. The growth is driven by increasing air travel and government initiatives to improve airport security and efficiency. The demand for biometric solutions is rising, supported by regulatory frameworks promoting digital transformation. Key airports like Soekarno-Hatta and Ngurah Rai are investing in advanced technologies to enhance passenger experience and operational capabilities.

Rest of APAC : Diverse Opportunities in Smaller Regions

The Rest of APAC market is valued at 0.86, representing a small fraction of the overall digital identity-in-airports market. However, niche opportunities are emerging in countries like Vietnam and the Philippines, driven by increasing air travel and government support for airport modernization. Demand for digital identity solutions is growing, albeit at a slower pace compared to larger markets. Local players are beginning to explore partnerships with global technology providers to enhance their offerings.