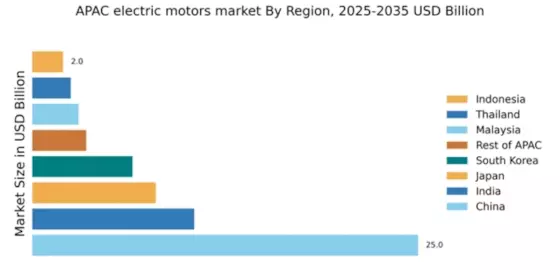

China : Unmatched Growth and Demand Trends

Key markets include major cities like Shanghai, Beijing, and Shenzhen, which are hubs for manufacturing and technology. The competitive landscape features significant players like Siemens, ABB, and Nidec Corporation, all vying for market share. Local dynamics are characterized by a robust supply chain and increasing investments in smart manufacturing. Industries such as automotive, HVAC, and renewable energy are primary consumers of electric motors, driving innovation and competition.

India : Emerging Market with High Potential

Key markets include Maharashtra, Gujarat, and Tamil Nadu, which are industrial powerhouses. The competitive landscape features players like Siemens and ABB, alongside local manufacturers. The business environment is improving due to favorable policies and a growing focus on sustainability. Industries such as textiles, automotive, and construction are significant consumers of electric motors, contributing to a dynamic market.

Japan : Advanced Solutions for Diverse Industries

Key markets include Tokyo, Osaka, and Nagoya, which are centers for technology and manufacturing. Major players like Mitsubishi Electric and Nidec Corporation dominate the landscape, focusing on innovation and quality. The local market is characterized by high competition and a strong emphasis on R&D. Industries such as robotics, automotive, and consumer electronics are primary consumers, driving the demand for advanced electric motor solutions.

South Korea : Key Player in Industrial Automation

Key markets include Seoul, Busan, and Incheon, which are hubs for technology and manufacturing. Major players like Siemens and Emerson Electric have a significant presence, competing in a dynamic landscape. The local business environment is favorable, with increasing investments in innovation and sustainability. Industries such as automotive, electronics, and machinery are key consumers of electric motors, driving growth and competition.

Malaysia : Emerging Hub for Manufacturing

Key markets include Selangor, Penang, and Johor, which are industrial centers. The competitive landscape features both local and international players, including ABB and Schneider Electric. The business environment is improving due to supportive government policies and a focus on innovation. Industries such as electronics, automotive, and construction are significant consumers of electric motors, driving demand and competition.

Thailand : Industrial Development Driving Demand

Key markets include Bangkok, Chonburi, and Rayong, which are industrial hubs. The competitive landscape features both local and international players, including Siemens and ABB. The local business environment is characterized by increasing investments in infrastructure and technology. Industries such as automotive, electronics, and food processing are primary consumers of electric motors, contributing to market growth.

Indonesia : Growth Driven by Infrastructure Projects

Key markets include Jakarta, Surabaya, and Bandung, which are major industrial centers. The competitive landscape features both local and international players, including General Electric and Schneider Electric. The business environment is improving due to supportive government policies and a focus on sustainability. Industries such as construction, automotive, and textiles are significant consumers of electric motors, driving demand and competition.

Rest of APAC : Varied Demand Across Sub-regions

Key markets include Vietnam, Philippines, and Singapore, each with unique industrial landscapes. The competitive landscape features a mix of local and international players, including Emerson Electric and Regal Rexnord. The business environment is characterized by varying levels of investment and regulatory support. Industries such as manufacturing, construction, and agriculture are primary consumers of electric motors, driving demand across the region.