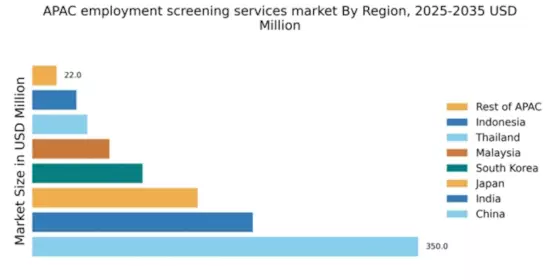

China : Robust Growth and Demand Trends

China holds a commanding market share of 350.0, representing approximately 45% of the APAC employment screening services market. Key growth drivers include rapid industrialization, increasing foreign investments, and a heightened focus on compliance with labor laws. Demand trends indicate a surge in background checks, particularly in sectors like technology and finance. Government initiatives, such as the implementation of stricter hiring regulations, further bolster this market. Infrastructure development, especially in urban areas, supports the growth of employment services.

India : Rapid Growth in Screening Services

India's employment screening market is valued at 200.0, accounting for about 25% of the APAC market. The growth is driven by the booming IT and service sectors, which demand thorough background checks. Increasing awareness of employee verification and compliance with labor laws are key trends. Government initiatives promoting skill development and employment generation also play a crucial role. The market is supported by a growing number of startups focusing on innovative screening solutions.

Japan : Cautious Growth Amid Regulations

Japan's employment screening market is valued at 150.0, representing around 19% of the APAC market. The growth is driven by a strong emphasis on corporate governance and compliance. Demand for screening services is particularly high in sectors like finance and healthcare, where regulatory scrutiny is intense. The government has introduced policies to enhance workforce quality, impacting hiring practices. However, cultural factors and privacy concerns pose challenges to market expansion.

South Korea : Innovative Solutions in Screening

South Korea's employment screening market is valued at 100.0, making up about 13% of the APAC market. The growth is fueled by a competitive job market and increasing demand for thorough background checks. Key sectors include technology and manufacturing, where compliance with safety regulations is critical. The government has implemented policies to enhance labor market transparency, driving demand for screening services. The competitive landscape features both local and international players offering innovative solutions.

Malaysia : Focus on Compliance and Quality

Malaysia's employment screening market is valued at 70.0, representing about 9% of the APAC market. The growth is driven by increasing foreign investments and a focus on compliance with labor laws. Demand trends indicate a rise in background checks across various sectors, including finance and healthcare. Government initiatives aimed at improving workforce quality and safety regulations further support market growth. The competitive landscape includes both local firms and international players.

Thailand : Regulatory Changes Driving Growth

Thailand's employment screening market is valued at 50.0, accounting for approximately 6% of the APAC market. The growth is driven by regulatory changes and an increasing focus on employee verification. Key sectors include tourism and manufacturing, where compliance is essential. Government initiatives to enhance labor market standards are also influencing demand. The competitive landscape features a mix of local and international players, adapting to evolving market needs.

Indonesia : Focus on Workforce Quality and Compliance

Indonesia's employment screening market is valued at 40.0, representing about 5% of the APAC market. The growth is driven by a burgeoning economy and increasing foreign investments. Demand for screening services is rising, particularly in sectors like manufacturing and services. Government initiatives aimed at improving labor market standards and compliance are also contributing to market growth. The competitive landscape includes both local and international players offering diverse solutions.

Rest of APAC : Fragmented Landscape and Opportunities

The Rest of APAC employment screening market is valued at 22.0, accounting for about 3% of the overall market. This sub-region includes various countries with unique regulatory environments and market dynamics. Growth is driven by increasing awareness of employee verification and compliance across sectors. Local government initiatives aimed at enhancing workforce quality are also influencing demand. The competitive landscape is fragmented, with numerous local players catering to specific market needs.