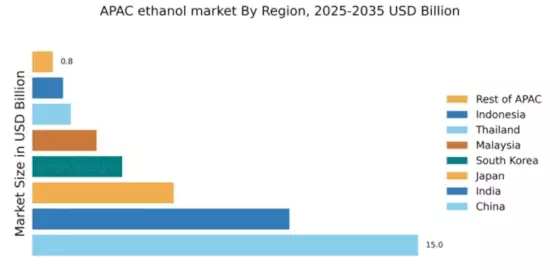

China : Robust Growth Driven by Demand

China holds a commanding 15.0% market share in the APAC ethanol sector, valued at approximately $X billion. Key growth drivers include increasing fuel demand, government support for biofuels, and a shift towards renewable energy sources. The Chinese government has implemented favorable policies, such as subsidies for ethanol production and blending mandates, which have spurred industrial development and infrastructure improvements in the sector. Additionally, urbanization and rising disposable incomes are driving consumption patterns towards cleaner fuels.

India : Government Initiatives Fuel Growth

India commands a 10.0% share of the APAC ethanol market, valued at around $X billion. The government's Ethanol Blending Program aims to increase ethanol usage in transportation fuels, driven by rising fuel prices and environmental concerns. Demand is also bolstered by the sugarcane surplus, which provides a cost-effective feedstock for ethanol production. Regulatory support, including tax incentives and blending mandates, is crucial for market expansion, alongside investments in infrastructure for production and distribution.

Japan : Focus on Sustainable Practices

Japan holds a 5.5% market share in the APAC ethanol sector, valued at approximately $X billion. The country is focusing on sustainable practices, driven by stringent environmental regulations and a commitment to reducing greenhouse gas emissions. Demand for biofuels is increasing, particularly in urban areas, as consumers seek cleaner energy alternatives. Government initiatives, such as subsidies for biofuel research and development, are fostering innovation in the sector, enhancing production efficiency and sustainability.

South Korea : Regulatory Support Enhances Market

South Korea accounts for a 3.5% share of the APAC ethanol market, valued at around $X billion. The government is actively promoting ethanol use through regulatory frameworks that encourage blending with gasoline. Key growth drivers include rising environmental awareness and the need for energy security. The country is investing in infrastructure to support ethanol production and distribution, with a focus on integrating biofuels into the existing energy landscape, enhancing overall market dynamics.

Malaysia : Diverse Feedstock Availability

Malaysia holds a 2.5% share of the APAC ethanol market, valued at approximately $X billion. The country's diverse agricultural landscape provides ample feedstock options, including palm oil and sugarcane, which are essential for ethanol production. Government policies promoting renewable energy and biofuels are driving market growth, alongside increasing domestic demand for cleaner fuels. Infrastructure investments are crucial for enhancing production capabilities and distribution networks, positioning Malaysia as a strategic player in the region.

Thailand : Government Policies Drive Adoption

Thailand captures a 1.5% share of the APAC ethanol market, valued at around $X billion. The Thai government has implemented policies to promote ethanol as a renewable energy source, particularly in the transportation sector. Demand is driven by rising fuel prices and environmental concerns, with a focus on reducing greenhouse gas emissions. Key cities like Bangkok and Chiang Mai are leading in ethanol consumption, supported by local production facilities and government incentives for biofuel adoption.

Indonesia : Focus on Renewable Energy Transition

Indonesia holds a 1.2% share of the APAC ethanol market, valued at approximately $X billion. The country is transitioning towards renewable energy sources, with ethanol being a key component of this strategy. Government initiatives, including blending mandates and subsidies for biofuel production, are driving market growth. The agricultural sector, particularly sugarcane and cassava production, plays a vital role in supplying feedstock for ethanol, enhancing local market dynamics and sustainability efforts.

Rest of APAC : Diverse Opportunities Across Regions

The Rest of APAC accounts for a 0.8% share of the ethanol market, valued at around $X billion. This sub-region includes various smaller markets with unique growth opportunities driven by local agricultural practices and energy policies. Countries are increasingly recognizing the potential of biofuels, leading to regulatory support and infrastructure development. The competitive landscape is characterized by local players and emerging startups focusing on sustainable practices and innovative production methods, enhancing market dynamics.