China : Rapid Growth and Innovation

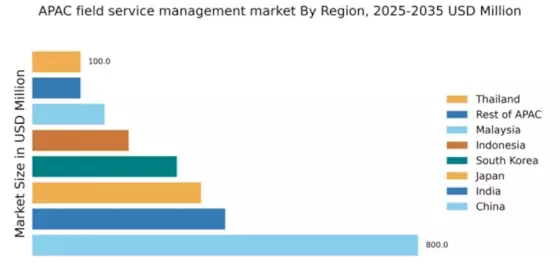

China holds a commanding market share of 40% in the APAC field service management sector, valued at $800.0 million. Key growth drivers include the rapid digital transformation across industries, increasing demand for automation, and government initiatives promoting smart manufacturing. The Chinese government has implemented policies to enhance infrastructure, particularly in urban areas, which supports the expansion of service management solutions.

India : Digital Adoption Fuels Growth

India accounts for 20% of the APAC market, valued at $400.0 million. The growth is driven by the increasing adoption of cloud-based solutions and mobile technologies. Demand trends indicate a shift towards integrated service management platforms, supported by government initiatives like Digital India, which aim to improve digital infrastructure. The rise of startups in the tech sector also contributes to market expansion.

Japan : Innovation and Efficiency Focus

Japan holds a 17.5% market share, valued at $350.0 million. The market is driven by a strong emphasis on technological innovation and efficiency in service delivery. Demand for IoT and AI-driven solutions is rising, supported by government policies promoting smart cities and automation. The aging population also necessitates improved service management in healthcare and elder care sectors.

South Korea : Focus on Smart Solutions

South Korea represents 15% of the APAC market, valued at $300.0 million. The growth is fueled by advancements in technology and a strong focus on smart solutions across various sectors. Government initiatives supporting digital transformation and infrastructure development are key drivers. The competitive landscape includes major players like SAP and Oracle, which have established a significant presence in the region.

Malaysia : Strategic Location and Development

Malaysia accounts for 7.5% of the APAC market, valued at $150.0 million. The growth is driven by the strategic location and government initiatives to enhance digital infrastructure. Demand for field service management solutions is increasing in sectors like telecommunications and utilities. The competitive landscape features both local and international players, with a focus on tailored solutions for SMEs.

Thailand : Digital Transformation in Progress

Thailand holds a 5% market share, valued at $100.0 million. The market is experiencing growth due to increasing digital transformation efforts across industries. Government initiatives aimed at enhancing the digital economy are driving demand for field service management solutions. Key cities like Bangkok and Chiang Mai are central to market activities, with a mix of local and international players competing.

Indonesia : Growth Driven by Urbanization

Indonesia represents 10% of the APAC market, valued at $200.0 million. The growth is driven by rapid urbanization and increasing demand for efficient service management solutions. Government initiatives to improve infrastructure and digital services are key factors. Major cities like Jakarta and Surabaya are focal points for market activities, with a competitive landscape featuring both local startups and established international firms.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC accounts for 5% of the market, valued at $100.0 million. This segment includes various countries with unique challenges and opportunities in field service management. Growth drivers vary by country, influenced by local regulations and market maturity. The competitive landscape is fragmented, with both local and international players vying for market share in specific sectors like agriculture and logistics.