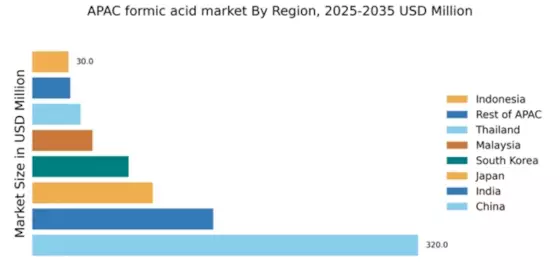

China : Robust Growth Driven by Demand

Key markets include Jiangsu, Shandong, and Guangdong provinces, where major industrial hubs are located. The competitive landscape features significant players like Shandong Jinmei Fenghua Chemical Company and BASF SE, which dominate the market. Local dynamics are characterized by a focus on innovation and sustainability, with businesses adapting to regulatory changes. The agricultural sector, along with textiles and pharmaceuticals, represents key applications for formic acid, driving further market expansion.

India : Growing Demand in Agriculture Sector

Key markets include Maharashtra, Gujarat, and Punjab, where agricultural activities are concentrated. The competitive landscape features players like BASF SE and Taminco, which are establishing a strong presence. Local market dynamics are shaped by a growing emphasis on organic farming and sustainable practices. Industries such as textiles and pharmaceuticals are also significant consumers of formic acid, contributing to its demand in the region.

Japan : Innovation Drives Formic Acid Use

Key markets include Tokyo and Osaka, where industrial activities are concentrated. The competitive landscape features major players like Mitsubishi Gas Chemical Company and Huntsman Corporation, which are known for their innovation. The local business environment is characterized by a focus on quality and compliance with stringent regulations. The electronics and automotive sectors are significant consumers of formic acid, driving its demand in specialized applications.

South Korea : Industrial Growth Fuels Demand

Key markets include Seoul and Ulsan, known for their industrial activities. The competitive landscape features players like Eastman Chemical Company and Ferro Corporation, which are expanding their market presence. Local dynamics are influenced by a strong emphasis on R&D and technological advancements. The automotive and textile industries are significant consumers of formic acid, contributing to its diverse applications in the region.

Malaysia : Focus on Sustainable Practices

Key markets include Selangor and Penang, where industrial activities are concentrated. The competitive landscape features players like BASF SE and local manufacturers, which are adapting to market needs. The local business environment is characterized by a focus on sustainability and compliance with regulations. The agricultural sector, along with textiles, represents significant applications for formic acid, driving its demand in the region.

Thailand : Agricultural Demand on the Rise

Key markets include Bangkok and Chonburi, where agricultural and industrial activities are concentrated. The competitive landscape features local players and international companies like BASF SE, which are establishing a presence. Local dynamics are characterized by a focus on sustainable practices and compliance with regulations. The agricultural sector is a significant consumer of formic acid, driving its demand in the region.

Indonesia : Industrial Growth and Agriculture Demand

Key markets include Jakarta and Surabaya, where industrial activities are concentrated. The competitive landscape features local manufacturers and international players like BASF SE, which are expanding their market presence. Local dynamics are influenced by a focus on sustainability and compliance with regulations. The agricultural sector, along with textiles, represents significant applications for formic acid, driving its demand in the region.

Rest of APAC : Emerging Opportunities Across Regions

Key markets include Vietnam and the Philippines, where industrial activities are growing. The competitive landscape features a mix of local and international players, adapting to regional demands. Local dynamics are characterized by a focus on sustainability and compliance with regulations. The agricultural sector is a significant consumer of formic acid, driving its demand in the region.