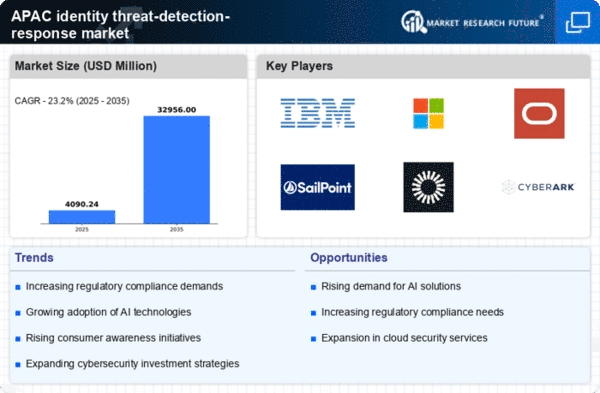

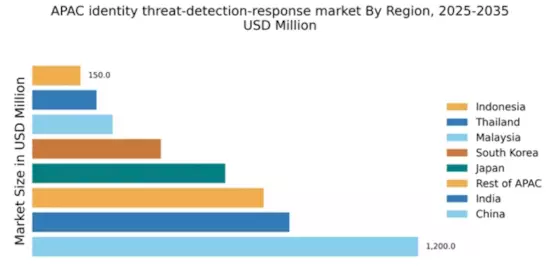

China : Robust Growth Driven by Innovation

China holds a commanding market share of 40% in the identity threat-detection-response sector, valued at $1200.0 million. Key growth drivers include rapid digital transformation, increasing cyber threats, and government initiatives promoting cybersecurity. The demand for advanced identity management solutions is rising, fueled by regulatory policies like the Cybersecurity Law, which mandates stringent data protection measures. Infrastructure development, particularly in tech hubs like Beijing and Shenzhen, further supports market expansion.

India : Rapid Digital Adoption Fuels Growth

India's identity threat-detection-response market is valued at $800.0 million, accounting for 25% of the APAC market. The surge in digital transactions and the rise of e-commerce are key growth drivers. Government initiatives like Digital India and the Personal Data Protection Bill are shaping the regulatory landscape, promoting secure identity management. The increasing adoption of cloud services and mobile applications is also driving demand for robust identity solutions.

Japan : Focus on Security and Compliance

Japan's market for identity threat-detection-response solutions is valued at $600.0 million, representing 20% of the APAC market. The growth is driven by stringent compliance requirements and a high level of technological adoption. The government’s Cybersecurity Strategy emphasizes the need for enhanced security measures across sectors. The demand for identity solutions is particularly strong in finance and healthcare, where data protection is critical.

South Korea : Government Support and Innovation

South Korea's identity threat-detection-response market is valued at $400.0 million, making up 13% of the APAC market. Key growth drivers include a robust cybersecurity framework and government support for innovation. The country’s Cybersecurity Act mandates organizations to implement effective identity management solutions. The competitive landscape features major players like IBM and Microsoft, particularly in urban centers like Seoul and Busan, where tech adoption is high.

Malaysia : Strategic Location for Cybersecurity

Malaysia's market is valued at $250.0 million, accounting for 8% of the APAC market. The growth is driven by increasing cyber threats and a growing awareness of data protection. Government initiatives like the National Cyber Security Policy promote the adoption of identity management solutions. Key markets include Kuala Lumpur and Penang, where the tech industry is expanding rapidly, attracting major players like Oracle and CyberArk.

Thailand : Investment in Digital Infrastructure

Thailand's identity threat-detection-response market is valued at $200.0 million, representing 6% of the APAC market. The growth is fueled by investments in digital infrastructure and increasing cyber threats. The government’s Digital Economy Promotion Agency is driving initiatives to enhance cybersecurity. Key cities like Bangkok are witnessing a rise in demand for identity solutions, with local players emerging alongside global giants like Okta.

Indonesia : Rising Awareness of Cyber Threats

Indonesia's market is valued at $150.0 million, making up 5% of the APAC market. The growth is driven by rising awareness of cyber threats and the need for secure identity management solutions. Government initiatives like the National Cybersecurity Strategy are promoting the adoption of identity solutions. Key markets include Jakarta and Surabaya, where the digital economy is expanding, attracting both local and international players.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC market is valued at $720.0 million, accounting for 22% of the overall APAC market. Growth drivers vary by country, influenced by local regulations and market maturity. Countries like Vietnam and the Philippines are seeing increased demand for identity solutions due to rising digitalization. The competitive landscape includes both local and international players, adapting to diverse market needs and regulatory environments.