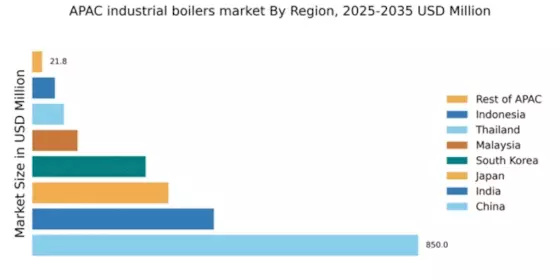

China : Unmatched Growth and Demand Trends

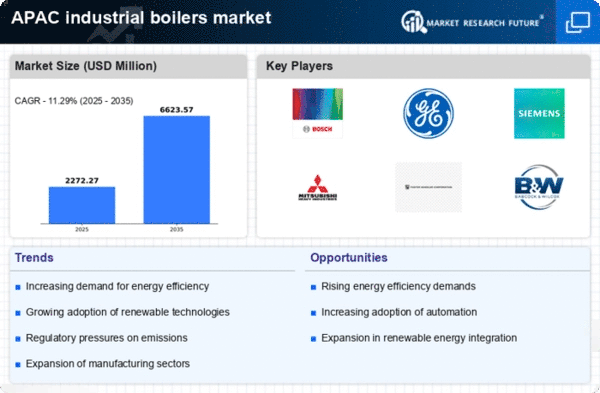

Key markets include major industrial hubs like Shanghai, Beijing, and Guangdong province. The competitive landscape features significant players such as Bosch, General Electric, and Mitsubishi Heavy Industries, all vying for market share. Local dynamics are influenced by a strong push for innovation and sustainability, with industries like power generation and manufacturing leading the way in boiler applications. The business environment is characterized by increasing investments in green technologies and infrastructure upgrades.

India : Emerging Market with High Potential

Key markets include Maharashtra, Gujarat, and Tamil Nadu, where industrial activities are concentrated. The competitive landscape features players like Siemens and Babcock & Wilcox, who are adapting to local needs. The business environment is evolving, with a focus on sustainability and efficiency. Industries such as chemicals and power generation are significant consumers of industrial boilers, driving innovation and competition in the sector.

Japan : Innovation Drives Market Growth

Key markets include Tokyo, Osaka, and Aichi Prefecture, where industrial activities are concentrated. Major players like Mitsubishi Heavy Industries and Alstom dominate the competitive landscape, focusing on innovation and quality. The business environment is characterized by high standards and stringent regulations, pushing companies to adopt advanced technologies. Industries such as automotive and electronics are significant users of industrial boilers, driving demand for cutting-edge solutions.

South Korea : Sustainable Solutions in Industry

Key markets include Seoul, Busan, and Incheon, where industrial activities are robust. The competitive landscape features major players like Siemens and Cleaver-Brooks, who are adapting to local market needs. The business environment is supportive of innovation, with a focus on sustainability. Industries such as petrochemicals and power generation are significant consumers of industrial boilers, driving the demand for efficient and eco-friendly solutions.

Malaysia : Emerging Market with Opportunities

Key markets include Selangor, Penang, and Johor, where industrial activities are concentrated. The competitive landscape features players like Bosch and General Electric, who are establishing a presence in the region. The business environment is evolving, with a focus on innovation and sustainability. Industries such as food processing and textiles are significant consumers of industrial boilers, driving demand for efficient solutions.

Thailand : Strategic Location for Manufacturing

Key markets include Bangkok, Chonburi, and Ayutthaya, where industrial activities are concentrated. The competitive landscape features players like Babcock & Wilcox and Thermo Dynamics, who are adapting to local market needs. The business environment is supportive of innovation, with a focus on sustainability. Industries such as automotive and food processing are significant consumers of industrial boilers, driving demand for advanced solutions.

Indonesia : Industrialization Drives Boiler Demand

Key markets include Jakarta, West Java, and East Java, where industrial activities are concentrated. The competitive landscape features players like General Electric and Cleaver-Brooks, who are establishing a presence in the region. The business environment is characterized by a focus on innovation and sustainability. Industries such as textiles and food processing are significant consumers of industrial boilers, driving demand for efficient solutions.

Rest of APAC : Varied Demand Across Sub-regions

Key markets include Vietnam, Philippines, and Bangladesh, where industrial activities are expanding. The competitive landscape is characterized by local players and international firms like Alstom and Bosch, who are adapting to regional needs. The business environment varies significantly, with some countries prioritizing sustainability while others focus on industrial growth. Industries such as textiles and food processing are significant consumers of industrial boilers, driving demand for efficient solutions.