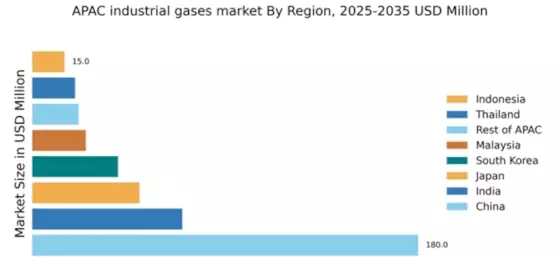

China : Unmatched Growth and Demand Trends

Key cities such as Shanghai, Beijing, and Shenzhen are pivotal in driving demand for industrial gases. The competitive landscape features major players like Air Liquide and Linde, who have established strong footholds through strategic partnerships and local production facilities. The business environment is dynamic, with a focus on innovation and technology adoption. Industries such as electronics, automotive, and food processing are significant consumers, driving tailored solutions in gas applications.

India : Growth Driven by Diverse Industries

Cities like Mumbai, Delhi, and Bengaluru are central to the industrial gases market, with significant demand from sectors such as pharmaceuticals, food processing, and metal fabrication. The competitive landscape includes players like Praxair and Air Products, who are expanding their operations to meet local needs. The business environment is characterized by a mix of traditional and modern industries, with a growing emphasis on innovation and efficiency in gas applications.

Japan : Innovation and Technology Focused

Key markets include Tokyo, Osaka, and Nagoya, where demand for industrial gases is robust. Major players like Taiyo Nippon Sanso Corporation and Linde dominate the landscape, leveraging advanced technologies to meet specific industry needs. The business environment is highly competitive, with a focus on R&D and customer-centric solutions. Industries such as automotive, electronics, and healthcare are significant consumers, driving tailored gas applications.

South Korea : Industrial Growth and Innovation

Key cities like Seoul and Busan are central to the industrial gases market, with significant demand from electronics and automotive industries. Major players such as Air Products and Messer Group have established a strong presence, focusing on innovation and customer service. The competitive landscape is characterized by a mix of local and international players, fostering a dynamic business environment. Industries such as electronics and chemicals are significant consumers, driving tailored gas solutions.

Malaysia : Strategic Location for Market Growth

Key markets include Kuala Lumpur and Penang, where demand for industrial gases is on the rise. Major players like Linde and Air Products are expanding their operations to meet local needs. The competitive landscape is characterized by a mix of local and international companies, fostering a dynamic business environment. Industries such as food processing, electronics, and healthcare are significant consumers, driving tailored gas applications.

Thailand : Industrial Growth and Sustainability Focus

Key cities like Bangkok and Chonburi are central to the industrial gases market, with significant demand from automotive and electronics industries. Major players such as Air Products and Linde have established a strong presence, focusing on innovation and customer service. The competitive landscape is characterized by a mix of local and international players, fostering a dynamic business environment. Industries such as automotive and food processing are significant consumers, driving tailored gas solutions.

Indonesia : Industrial Gases for Diverse Sectors

Key markets include Jakarta and Surabaya, where demand for industrial gases is on the rise. Major players like Air Products and Linde are expanding their operations to meet local needs. The competitive landscape is characterized by a mix of local and international companies, fostering a dynamic business environment. Industries such as food processing, chemicals, and healthcare are significant consumers, driving tailored gas applications.

Rest of APAC : Varied Applications Across Sub-regions

Key markets include Vietnam, Philippines, and Singapore, where demand for industrial gases is growing. Major players like Messer Group and Matheson Tri-Gas are expanding their presence to cater to local needs. The competitive landscape is diverse, with a mix of local and international players. Industries such as food processing, electronics, and healthcare are significant consumers, driving tailored gas applications.