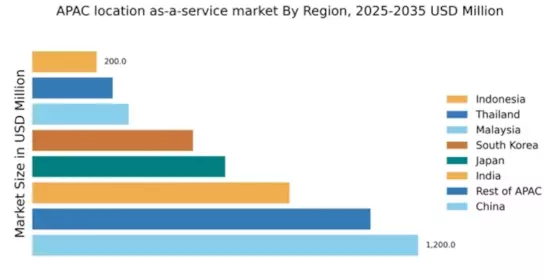

China : Rapid Growth and Innovation Hub

Key markets include major cities such as Beijing, Shanghai, and Shenzhen, where competition is fierce among local and international players. Companies like HERE Technologies and Google are establishing strong footholds, while local firms like Baidu are also significant competitors. The business environment is characterized by a blend of innovation and regulatory challenges, particularly in data management. Industries such as transportation, retail, and real estate are increasingly adopting location services to enhance operational efficiency.

India : Rapid Digital Transformation Underway

Key markets include metropolitan areas such as Mumbai, Delhi, and Bangalore, where competition is intensifying among both domestic and international players. Major companies like Google and Mapbox are actively investing in local partnerships. The business environment is dynamic, with startups emerging in the logistics and transportation sectors. Industries such as retail and tourism are leveraging location services to improve customer engagement and operational efficiency.

Japan : Integration of AI and Location Services

Tokyo and Osaka are key markets, with a competitive landscape featuring major players like Esri and HERE Technologies. The presence of local tech giants such as SoftBank adds to the competitive dynamics. The business environment is characterized by a strong emphasis on quality and reliability. Industries such as automotive and logistics are increasingly adopting location services to optimize operations and enhance user experiences.

South Korea : Smart City Initiatives in Focus

Seoul is the primary market, with a competitive landscape featuring major players like Google and Telenav. The business environment is conducive to innovation, with a strong focus on R&D. Local companies are also emerging, contributing to a vibrant ecosystem. Industries such as retail and healthcare are leveraging location services to enhance customer experiences and operational efficiency.

Malaysia : Focus on Digital Economy Development

Key markets include Kuala Lumpur and Penang, where competition is growing among local and international players. Companies like Google and Mapbox are establishing partnerships with local firms. The business environment is evolving, with a focus on innovation and digital transformation. Industries such as logistics and retail are increasingly adopting location services to improve efficiency and customer engagement.

Thailand : Tourism and E-commerce Driving Demand

Key markets include Bangkok and Chiang Mai, where competition is intensifying among both domestic and international players. Major companies like Google and Foursquare are actively investing in local partnerships. The business environment is dynamic, with startups emerging in the logistics and tourism sectors. Industries such as retail and hospitality are leveraging location services to enhance customer experiences and operational efficiency.

Indonesia : Urbanization Fuels Location Demand

Key markets include Jakarta and Surabaya, where competition is growing among local and international players. Companies like Google and HERE Technologies are establishing strong presences. The business environment is characterized by a blend of innovation and regulatory challenges, particularly in data management. Industries such as transportation and retail are increasingly adopting location services to improve operational efficiency and customer engagement.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include emerging economies in Southeast Asia and Pacific Islands, where competition is growing among local and international players. Major companies like Esri and Mapbox are expanding their reach. The business environment is diverse, with varying levels of infrastructure and digital adoption. Industries such as agriculture, tourism, and logistics are leveraging location services to enhance operational efficiency and customer experiences.