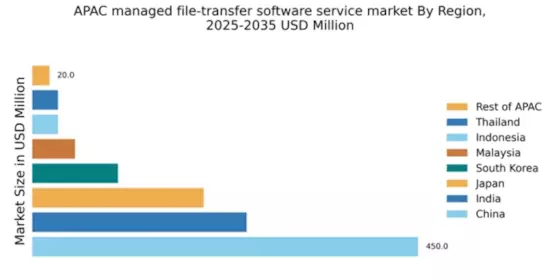

China : Robust Growth and Innovation Hub

China holds a commanding market share of 45% in the managed file-transfer software service sector, valued at $450.0 million. Key growth drivers include rapid digital transformation, increasing cybersecurity concerns, and government initiatives promoting cloud adoption. The demand for secure data exchange is surging, particularly in finance and healthcare sectors, supported by regulatory frameworks like the Cybersecurity Law, which mandates stringent data protection measures. Infrastructure development, especially in tier-1 cities like Beijing and Shanghai, further fuels this growth.

India : Rapid Digital Transformation Underway

India's market share stands at 25% with a value of $250.0 million, driven by a burgeoning IT sector and increasing demand for secure file transfers. The rise of e-commerce and digital payments has heightened the need for reliable data exchange solutions. Government initiatives like Digital India are fostering a conducive environment for tech adoption, while regulatory frameworks ensure data privacy and security. The growing startup ecosystem in cities like Bengaluru and Hyderabad is also contributing to market expansion.

Japan : Strong Demand in Established Industries

Japan accounts for 20% of the market, valued at $200.0 million, characterized by a strong emphasis on technological innovation and reliability. Key growth drivers include the increasing need for secure data management in sectors like manufacturing and finance. The government’s focus on enhancing cybersecurity through initiatives like the Cybersecurity Strategy is pivotal. The market is witnessing a shift towards cloud-based solutions, driven by major players like IBM and Microsoft, particularly in urban centers such as Tokyo and Osaka.

South Korea : Growing Demand in Tech Sector

South Korea holds a 10% market share, valued at $100.0 million, with significant growth driven by its advanced technology landscape. The demand for managed file-transfer solutions is rising, particularly in sectors like telecommunications and finance. Government policies promoting digital innovation and cybersecurity are enhancing market conditions. Key cities like Seoul are central to this growth, with major players like Cleo and Globalscape establishing a strong presence, catering to local businesses and multinational corporations alike.

Malaysia : Focus on Security and Compliance

Malaysia's market share is 5%, valued at $50.0 million, with growth driven by increasing regulatory compliance and data security needs. The government’s initiatives, such as the Personal Data Protection Act, are shaping the demand for secure file transfer solutions. The market is expanding in key areas like Kuala Lumpur and Penang, where local enterprises are increasingly adopting digital solutions. Major players like Progress Software are capitalizing on this trend, providing tailored services to meet local requirements.

Thailand : Focus on E-commerce and Security

Thailand represents a 3% market share, valued at $30.0 million, with growth fueled by the rapid expansion of e-commerce and digital services. The government’s Thailand 4.0 initiative is promoting digital transformation across industries, enhancing the need for secure file transfer solutions. Key markets include Bangkok and Chiang Mai, where local businesses are increasingly adopting technology. The competitive landscape features both local and international players, with a focus on compliance and security in data management.

Indonesia : Rapid Growth in Tech Adoption

Indonesia holds a 3% market share, valued at $30.0 million, with significant growth potential driven by increasing internet penetration and digital service adoption. Government initiatives aimed at enhancing digital infrastructure are pivotal in shaping the market. Key cities like Jakarta and Surabaya are witnessing a surge in demand for secure file transfer solutions, particularly in finance and retail sectors. The competitive landscape includes both local startups and established international players, focusing on tailored solutions for diverse industries.

Rest of APAC : Varied Demand Across Sub-regions

The Rest of APAC accounts for a 2% market share, valued at $20.0 million, characterized by diverse market needs and varying levels of digital adoption. Growth is driven by localized demand for secure file transfer solutions across different industries. Regulatory environments differ significantly, influencing market dynamics. Key markets include smaller nations like Vietnam and the Philippines, where local players are emerging alongside established international firms. The focus is on compliance and security, catering to specific regional requirements.