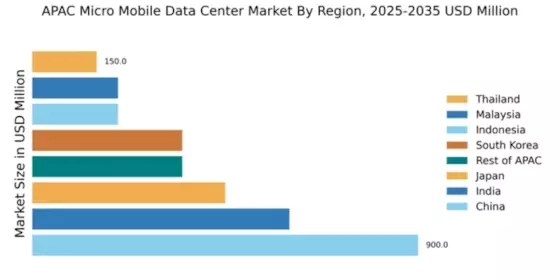

China : Unmatched Growth and Innovation

China holds a commanding market share of 36% in the micro mobile-data-center sector, valued at $900.0 million. Key growth drivers include rapid urbanization, increasing demand for cloud services, and government initiatives promoting digital transformation. The Chinese government has implemented favorable policies to enhance infrastructure, particularly in Tier 1 cities like Beijing and Shanghai, where tech adoption is highest. The industrial development is further supported by investments in 5G technology and smart city projects.

India : Emerging Tech Hub of APAC

India captures 25% of the APAC market, valued at $600.0 million. The growth is fueled by the increasing adoption of cloud computing and the rise of startups in cities like Bengaluru and Hyderabad. Government initiatives like Digital India are enhancing infrastructure and regulatory frameworks, promoting data localization and security. The demand for micro data centers is also driven by the need for edge computing solutions in various sectors, including finance and healthcare.

Japan : Innovation Meets Reliability

Japan holds a 20% market share, valued at $450.0 million. The growth is driven by the country's focus on advanced technology and automation. Demand for micro data centers is increasing in urban areas like Tokyo and Osaka, where businesses seek efficient solutions for data processing. Regulatory support for energy-efficient technologies and disaster recovery initiatives further bolster market growth. The competitive landscape includes major players like IBM and Schneider Electric, focusing on high-quality solutions.

South Korea : Leading in Digital Transformation

South Korea accounts for 15% of the market, valued at $350.0 million. The growth is propelled by the government's push for smart city initiatives and 5G deployment. Key cities like Seoul and Busan are witnessing a surge in demand for micro data centers to support IoT applications and data analytics. The competitive environment features strong local players alongside global giants like Cisco Systems, emphasizing innovation and reliability in their offerings.

Malaysia : Strategic Location for Growth

Malaysia represents 8% of the APAC market, valued at $200.0 million. The growth is driven by the country's strategic location and government incentives for tech investments. Cities like Kuala Lumpur and Penang are becoming hubs for data center operations, supported by initiatives like the Malaysia Digital Economy Corporation. The competitive landscape includes both local and international players, focusing on cost-effective and scalable solutions for various industries.

Thailand : Investment in Digital Infrastructure

Thailand holds a 6% market share, valued at $150.0 million. The growth is fueled by increasing internet penetration and government initiatives to enhance digital infrastructure. Key cities like Bangkok and Chiang Mai are seeing rising demand for micro data centers, particularly in sectors like e-commerce and finance. The market is characterized by a mix of local and international players, with a focus on providing tailored solutions to meet local needs.

Indonesia : Potential for Rapid Growth

Indonesia captures 8% of the market, valued at $200.0 million. The growth is driven by the increasing adoption of digital services and government support for tech infrastructure. Key cities like Jakarta and Surabaya are emerging as data center hubs, with a focus on enhancing connectivity and service delivery. The competitive landscape includes both local firms and international players, emphasizing the need for scalable and efficient solutions to meet growing demand.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC accounts for 15% of the market, valued at $350.0 million. Growth is driven by varying demand across countries, influenced by local regulations and infrastructure development. Regions like Vietnam and the Philippines are witnessing increased investments in data centers, supported by government initiatives. The competitive landscape is diverse, with both regional and The micro mobile-data-center market share, focusing on localized solutions to cater to specific needs.