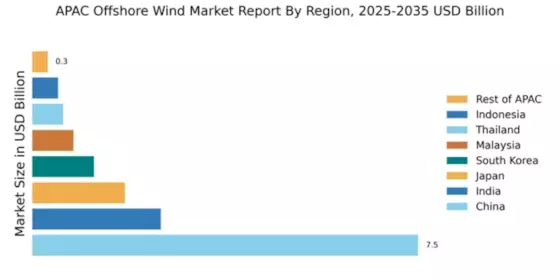

China : Unmatched Growth and Investment Potential

Key markets include coastal provinces like Jiangsu, Guangdong, and Zhejiang, where major players like Orsted and Siemens Gamesa are establishing significant operations. The competitive landscape is characterized by a mix of domestic and international firms, with local companies rapidly scaling up capabilities. The business environment is bolstered by a strong supply chain and a growing focus on sustainable energy applications, particularly in manufacturing and urban infrastructure.

India : Strategic Growth and Investment Opportunities

Key markets include coastal regions such as Gujarat and Tamil Nadu, where significant projects are underway. The competitive landscape features players like GE Renewable Energy and Siemens Gamesa, who are partnering with local firms to navigate regulatory frameworks. The business environment is evolving, with increasing interest from foreign investors and a focus on integrating offshore wind into the broader energy mix, particularly for industrial applications.

Japan : Balancing Tradition with Modern Energy

Key markets include regions like Akita and Fukushima, where pilot projects are being developed. The competitive landscape is marked by local players such as MHI Vestas and international firms like Orsted. The business environment is characterized by a cautious yet optimistic approach, with regulatory frameworks evolving to support offshore wind, particularly in the fishing and tourism sectors, which are crucial to local economies.

South Korea : Government Support and Investment Growth

Key markets include Jeju Island and the southwestern coast, where significant projects are being developed. Major players like Siemens Gamesa and GE Renewable Energy are actively participating in the market. The competitive landscape is evolving, with a focus on local partnerships and technology transfer. The business environment is becoming increasingly favorable, with a strong emphasis on integrating offshore wind into the national energy strategy, particularly for industrial applications.

Malaysia : Investment Opportunities on the Horizon

Key markets include states like Penang and Sabah, where initial projects are being planned. The competitive landscape is nascent, with players like Vestas and local firms beginning to explore opportunities. The business environment is developing, with increasing interest from foreign investors and a focus on aligning offshore wind projects with local economic development goals, particularly in tourism and fisheries.

Thailand : Sustainable Energy Transition Efforts

Key markets include coastal provinces like Chonburi and Rayong, where initial projects are being developed. The competitive landscape features local players and international firms like Nordex beginning to enter the market. The business environment is evolving, with a focus on integrating offshore wind into the national energy strategy, particularly for industrial applications and urban development.

Indonesia : Potential for Future Growth

Key markets include regions like Bali and Sumatra, where feasibility studies are being conducted. The competitive landscape is largely undeveloped, with few players currently active. The business environment is challenging but improving, with increasing interest from international investors and a focus on aligning offshore wind projects with local energy needs and economic development goals.

Rest of APAC : Regional Variations and Growth Potential

Key markets include emerging economies in Southeast Asia and Pacific Island nations, where local governments are beginning to explore offshore wind. The competitive landscape is fragmented, with a mix of local and international players starting to engage. The business environment is characterized by varying levels of regulatory support and investment interest, with a focus on integrating offshore wind into national energy strategies, particularly for energy security and sustainability.