China : Unmatched Growth and Innovation

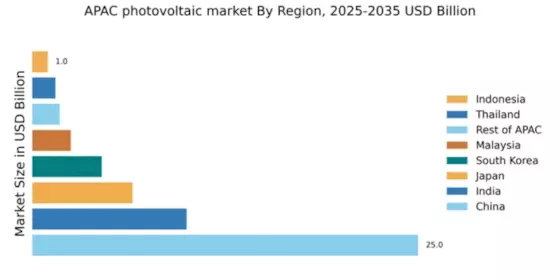

China holds a commanding 25.0% market share in the APAC photovoltaic sector, valued at approximately $50 billion. Key growth drivers include robust government policies promoting renewable energy, significant investments in solar technology, and a rapidly expanding manufacturing base. Demand is fueled by urbanization and industrialization, with initiatives like the 14th Five-Year Plan emphasizing clean energy. Infrastructure development, particularly in solar farms and grid integration, further supports this growth.

India : Government Initiatives Fuel Growth

India's photovoltaic market accounts for 10.0% of the APAC share, valued at around $20 billion. The government's ambitious targets, such as the National Solar Mission, aim for 100 GW of solar capacity by 2022, driving demand. Urban areas like Delhi and Mumbai are witnessing increased solar adoption, supported by favorable policies and incentives. The growing middle class and industrial sector are also contributing to consumption patterns favoring solar energy.

Japan : Technological Advancements Drive Market

Japan holds a 6.5% market share in the APAC photovoltaic sector, valued at approximately $13 billion. The market is driven by technological innovations and a strong focus on energy efficiency. Government incentives, such as feed-in tariffs, have spurred residential solar installations. Demand is particularly high in urban areas like Tokyo and Osaka, where space constraints encourage innovative solar solutions, including building-integrated photovoltaics.

South Korea : Government Policies Propel Growth

South Korea's photovoltaic market represents 4.5% of the APAC share, valued at about $9 billion. The government has set ambitious renewable energy targets, aiming for 20% of total energy from renewables by 2030. Key cities like Seoul and Busan are leading in solar adoption, supported by incentives and subsidies. The competitive landscape features major players like Hanwha Q CELLS, which dominate the local market with advanced technology and production capabilities.

Malaysia : Investment Opportunities Abound

Malaysia captures 2.5% of the APAC photovoltaic market, valued at around $5 billion. The government is actively promoting solar energy through initiatives like the Net Energy Metering scheme, which encourages residential and commercial installations. Key markets include Selangor and Penang, where industrial growth is driving demand. The competitive landscape includes local players and international firms, creating a dynamic business environment for solar energy.

Thailand : Diverse Applications Drive Demand

Thailand holds a 1.5% market share in the APAC photovoltaic sector, valued at approximately $3 billion. The government’s Power Development Plan aims to increase renewable energy contributions, fostering demand for solar solutions. Key markets include Bangkok and Chiang Mai, where both residential and commercial sectors are adopting solar technologies. The competitive landscape features local and international players, enhancing market dynamics and innovation.

Indonesia : Growing Awareness and Adoption

Indonesia's photovoltaic market accounts for 1.0% of the APAC share, valued at around $2 billion. The government is beginning to recognize the potential of solar energy, with initiatives aimed at increasing renewable energy usage. Key regions include Java and Bali, where demand is growing due to rising electricity costs and environmental awareness. The market is still developing, with opportunities for both local and foreign investors.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC captures a 1.77% market share in the photovoltaic sector, valued at approximately $3.5 billion. This sub-region includes various countries with differing regulatory environments and market dynamics. Growth is driven by local initiatives and international investments, with countries like Vietnam and the Philippines showing promise. The competitive landscape is fragmented, with both local and international players vying for market share, creating unique challenges and opportunities.