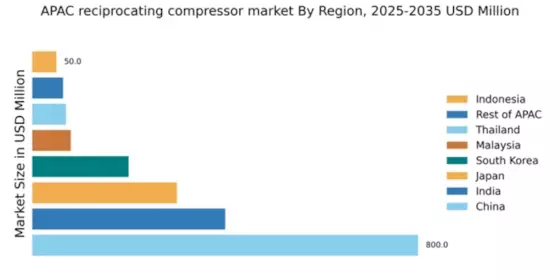

China : Robust Growth Driven by Industry Demand

China holds a commanding market share of 50% in the reciprocating compressor market, valued at $800.0 million. Key growth drivers include rapid industrialization, increased energy demand, and government initiatives promoting manufacturing. The demand for energy-efficient compressors is rising, supported by regulatory policies aimed at reducing emissions. Infrastructure development, particularly in urban areas, is further fueling consumption patterns in various sectors.

India : Strong Demand from Diverse Industries

India accounts for 20% of the APAC market, valued at $400.0 million. The growth is driven by expanding sectors such as automotive, pharmaceuticals, and food processing. Increasing urbanization and government initiatives like 'Make in India' are boosting demand for reciprocating compressors. Regulatory frameworks are evolving to support sustainable practices, enhancing market attractiveness.

Japan : Mature Market with Steady Growth

Japan holds a 15% market share, valued at $300.0 million. The market is characterized by high demand for advanced technology and energy-efficient solutions. Key growth drivers include the automotive and electronics sectors, which require reliable compressor systems. Government policies emphasize innovation and sustainability, fostering a conducive environment for market growth.

South Korea : Key Player in Advanced Manufacturing

South Korea represents 10% of the market, valued at $200.0 million. The growth is propelled by the manufacturing sector, particularly in electronics and automotive industries. Government initiatives focus on enhancing industrial efficiency and sustainability, driving demand for reciprocating compressors. The competitive landscape features both local and international players, ensuring a dynamic market environment.

Malaysia : Focus on Sustainable Development

Malaysia accounts for 4% of the APAC market, valued at $80.0 million. The growth is driven by the oil and gas sector, alongside increasing investments in manufacturing. Government policies promoting sustainable practices and infrastructure development are key growth drivers. Demand for energy-efficient compressors is rising, aligning with national sustainability goals.

Thailand : Diverse Applications Across Industries

Thailand holds a 3.5% market share, valued at $70.0 million. The market is supported by a robust manufacturing sector, particularly in automotive and electronics. Government initiatives to attract foreign investment and enhance industrial capabilities are driving growth. The competitive landscape includes both local and international players, fostering innovation and efficiency.

Indonesia : Focus on Infrastructure Development

Indonesia represents 2.5% of the market, valued at $50.0 million. The growth is driven by increasing infrastructure projects and industrialization efforts. Government initiatives aimed at enhancing manufacturing capabilities are boosting demand for reciprocating compressors. The market is characterized by a mix of local and international players, creating a competitive environment.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for 3.2% of the market, valued at $64.0 million. Growth is driven by diverse industrial applications across various countries. Regulatory frameworks and government initiatives vary, impacting market dynamics. The competitive landscape features a mix of local and international players, ensuring a dynamic market environment.