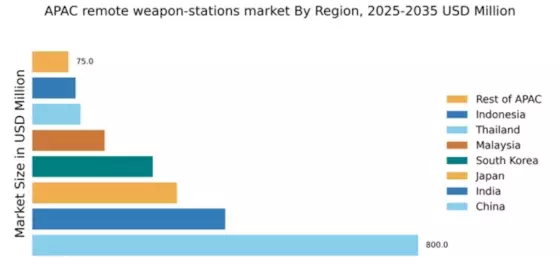

China : Strong Growth Driven by Defense Needs

China holds a commanding market share of 53.3% in the APAC remote weapon stations market, valued at $800.0 million. Key growth drivers include increased defense spending, modernization of military capabilities, and a focus on indigenous technology development. Demand trends show a rising preference for advanced unmanned systems, supported by government initiatives aimed at enhancing national security. Infrastructure development, particularly in defense manufacturing, is also a significant factor.

India : Government Initiatives Fueling Growth

Key markets include New Delhi, Bengaluru, and Pune, where major defense hubs are located. The competitive landscape features significant players like Bharat Electronics and Larsen & Toubro, alongside international firms. The local market is characterized by a mix of public and private sector involvement, with applications spanning land, naval, and aerial defense systems.

Japan : Focus on Modernization and Innovation

Key markets include Tokyo and Yokohama, where defense contractors are concentrated. The competitive landscape features major players like Mitsubishi Heavy Industries and NEC Corporation. The business environment is characterized by stringent regulations and a focus on quality and innovation, with applications primarily in maritime and aerial defense sectors.

South Korea : Modernization Efforts Shape Market Dynamics

Key markets include Seoul and Daejeon, which are home to major defense firms. The competitive landscape features companies like Hanwha Defense and LIG Nex1. The local market is characterized by a collaborative environment between government and industry, with applications in land and naval defense systems.

Malaysia : Government Focus on Defense Modernization

Key markets include Kuala Lumpur and Penang, where defense contractors are increasingly active. The competitive landscape features local players like Deftech and international firms such as Thales Group. The business environment is evolving, with a focus on public-private partnerships and applications in land and maritime defense.

Thailand : Defense Spending on the Rise

Key markets include Bangkok and Chonburi, where defense activities are concentrated. The competitive landscape features local firms like Defence Technology Institute and international players. The local market dynamics are characterized by a mix of public sector initiatives and private sector participation, with applications in land and maritime defense.

Indonesia : Focus on National Security Enhancements

Key markets include Jakarta and Surabaya, where defense activities are increasingly prominent. The competitive landscape features local players like PT Pindad and international firms. The business environment is evolving, with a focus on partnerships and collaborations, particularly in land and naval defense applications.

Rest of APAC : Varied Demand Across Sub-regions

Key markets include Vietnam and the Philippines, where defense modernization efforts are underway. The competitive landscape features a mix of local and international players, with varying degrees of market penetration. The local business environment is characterized by unique challenges and opportunities, with applications spanning land, naval, and aerial defense sectors.