Growth in Construction Activities

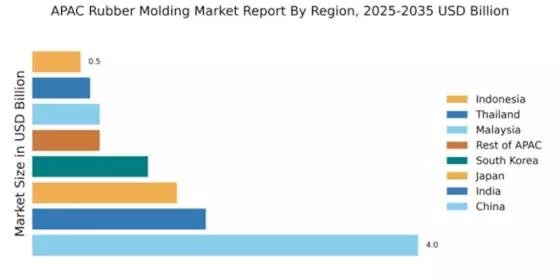

The rubber molding market in APAC is experiencing a notable surge due to the rapid expansion of construction activities across the region. Countries such as India and China are investing heavily in infrastructure development, which is anticipated to drive the demand for rubber molded products. The construction sector's growth is projected to increase by approximately 7% annually, leading to a heightened need for durable and flexible materials. Rubber molded components are essential in various applications, including seals, gaskets, and flooring solutions, which are integral to modern construction projects. As urbanization continues to rise, the rubber molding market is likely to benefit from the increasing requirement for high-performance materials that can withstand diverse environmental conditions. This trend suggests a robust future for rubber molding manufacturers catering to the construction sector in APAC.

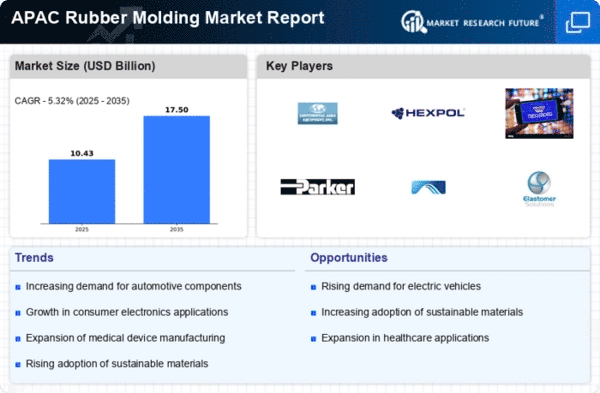

Expansion of Automotive Manufacturing

The rubber molding market is significantly influenced by the expansion of automotive manufacturing in APAC. Countries like Japan, South Korea, and China are recognized as major automotive hubs, with production levels reaching millions of vehicles annually. The automotive sector's growth is projected to increase by approximately 8% in the coming years, which will likely drive the demand for rubber molded components used in various vehicle parts, such as tires, seals, and interior fittings. As automotive manufacturers focus on enhancing vehicle performance and safety, the need for high-quality rubber products becomes paramount. This trend indicates a promising outlook for the rubber molding market, as it aligns with the automotive sector's evolving requirements.

Rising Demand from Consumer Goods Sector

The rubber molding market is experiencing a significant boost from the consumer goods sector in APAC. With the increasing disposable income and changing lifestyles, there is a growing demand for rubber products in various consumer applications, including household items, toys, and sporting goods. The market for consumer goods is projected to grow at a rate of around 6% annually, which is likely to enhance the demand for rubber molded components. These products are favored for their durability, flexibility, and cost-effectiveness. As manufacturers strive to meet the evolving preferences of consumers, the rubber molding market is expected to expand, providing innovative solutions that cater to diverse consumer needs.

Technological Innovations in Manufacturing

Technological advancements are playing a pivotal role in shaping the rubber molding market in APAC. The integration of automation and advanced manufacturing techniques, such as 3D printing and computer-aided design (CAD), is enhancing production efficiency and product quality. These innovations allow manufacturers to produce complex rubber components with precision, reducing waste and lowering production costs. The market is witnessing a shift towards smart manufacturing, where data analytics and IoT are utilized to optimize processes. This shift is expected to increase the market's value by approximately 5% over the next few years. As manufacturers adopt these technologies, they are likely to improve their competitive edge, thereby driving growth in the rubber molding market across APAC.

Increased Focus on Environmental Regulations

The rubber molding market in APAC is adapting to the heightened focus on environmental regulations and sustainability practices. Governments across the region are implementing stricter regulations regarding the use of materials and waste management, prompting manufacturers to seek eco-friendly alternatives. This shift is likely to drive innovation in the production of rubber molded products, with an emphasis on using sustainable materials and processes. The market is expected to see a growth rate of around 4% as companies invest in greener technologies and practices. As consumers become more environmentally conscious, the demand for sustainable rubber products is anticipated to rise, further influencing the rubber molding market in APAC.