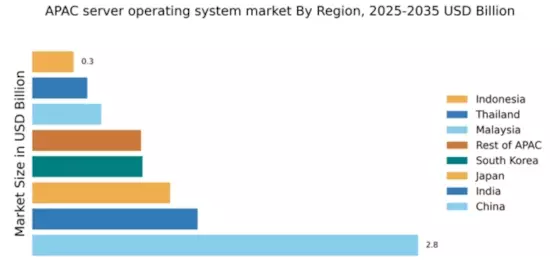

China : Unmatched Growth and Innovation

China holds a commanding 2.8% market share in the APAC server operating system market, driven by rapid digital transformation and government initiatives promoting cloud computing. The demand for advanced server solutions is fueled by the booming e-commerce sector and increasing investments in AI and big data. Regulatory support, such as the Cybersecurity Law, encourages local data centers and enhances infrastructure development, creating a robust ecosystem for server OS adoption.

India : Emerging Market with High Potential

Key markets include Bengaluru, Hyderabad, and Pune, which are tech hubs attracting major players like Microsoft and Red Hat. The competitive landscape is characterized by a mix of global and local vendors, with a growing emphasis on open-source solutions. The business environment is favorable, supported by a young workforce and increasing investments in technology sectors such as fintech and e-commerce.

Japan : Technologically Advanced Market Dynamics

Tokyo and Osaka are key markets, hosting major data centers and tech companies. The competitive landscape features strong players like Oracle and VMware, alongside local firms. The business environment is characterized by high standards for quality and security, with significant applications in finance, healthcare, and manufacturing sectors.

South Korea : Strong Market with Competitive Edge

Seoul and Busan are pivotal markets, with a competitive landscape featuring major players like IBM and Amazon. The local business environment is dynamic, with a strong emphasis on R&D and innovation. Key sectors include telecommunications, gaming, and e-commerce, where server OS applications are increasingly vital.

Malaysia : Strategic Growth in Digital Economy

Kuala Lumpur and Penang are significant markets, attracting both local and international players like SUSE and Canonical. The competitive landscape is evolving, with a focus on hybrid cloud solutions. The business environment is favorable, supported by a growing tech-savvy population and increasing investments in sectors like e-commerce and fintech.

Thailand : Market Potential in Tech Adoption

Bangkok and Chiang Mai are key markets, with a competitive landscape featuring both global and local vendors. Major players like Microsoft and Oracle have a significant presence. The business environment is improving, with increasing investments in sectors such as tourism, retail, and logistics, where server OS applications are becoming essential.

Indonesia : Digital Transformation on the Rise

Jakarta and Surabaya are key markets, with a competitive landscape featuring both international and local players. Major companies like Amazon and Red Hat are establishing a presence. The business environment is evolving, with a growing focus on technology adoption in sectors such as retail, finance, and education.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include Vietnam, Philippines, and Singapore, each with unique competitive landscapes. Major players like VMware and IBM are present, but local vendors are also emerging. The business environment varies, with sectors such as manufacturing, finance, and telecommunications increasingly relying on server OS solutions.