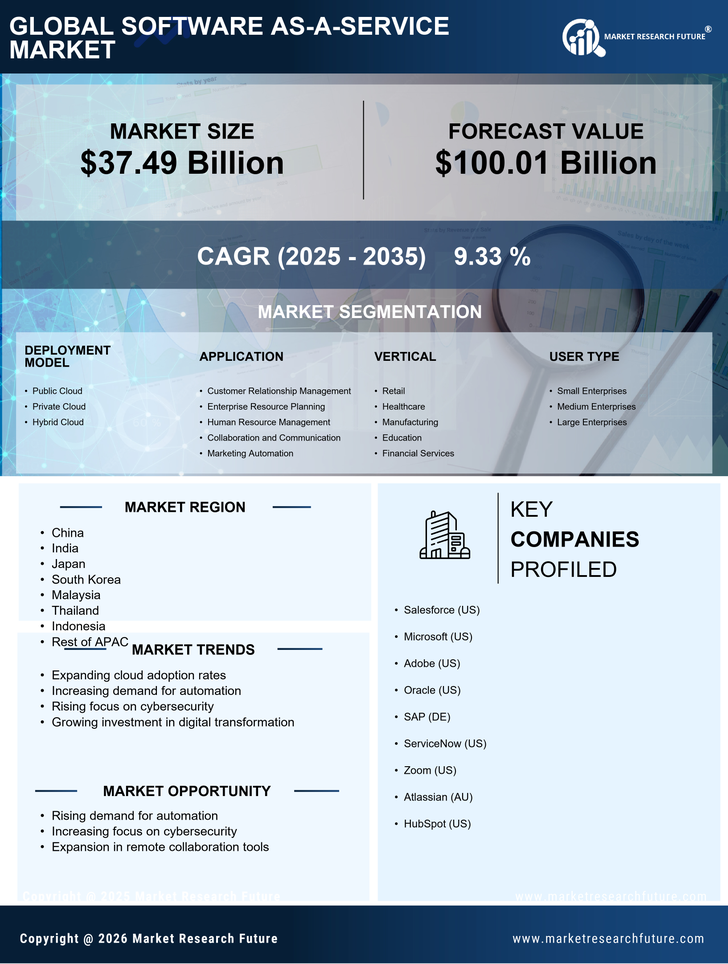

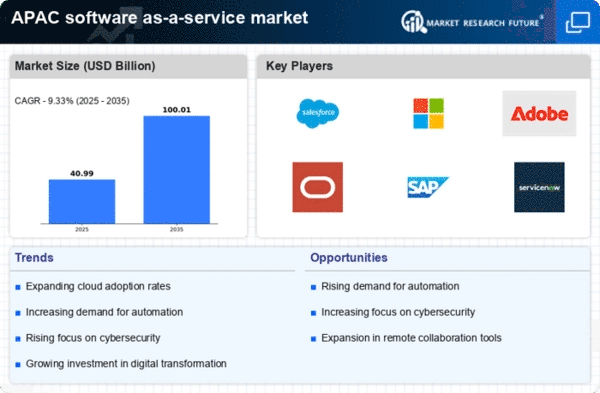

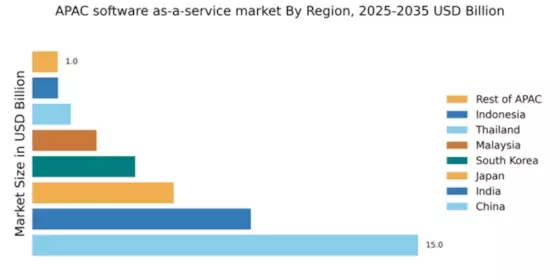

China : Rapid Growth and Innovation Hub

China holds a commanding 15.0% market share in the APAC SaaS sector, valued at approximately $15 billion. Key growth drivers include a robust digital economy, increasing cloud adoption, and government initiatives promoting technology innovation. Demand trends show a shift towards AI-driven solutions and enhanced cybersecurity measures. The Chinese government has implemented favorable policies to support tech startups, while significant investments in infrastructure bolster industrial development.

India : Innovation and Start-up Ecosystem

India's SaaS market is growing rapidly, capturing 8.5% of the APAC share, valued at around $8.5 billion. The growth is driven by a vibrant startup ecosystem, increasing internet penetration, and a young, tech-savvy population. Demand for SaaS solutions is rising in sectors like e-commerce, healthcare, and education, supported by government initiatives like Digital India, which promotes digital transformation across industries.

Japan : Technology Adoption and Integration

Japan's SaaS market accounts for 5.5% of the APAC share, valued at approximately $5.5 billion. Key growth drivers include the aging population's demand for digital solutions and the government's push for automation in various sectors. The market is characterized by a strong preference for local vendors, with increasing adoption of cloud services in traditional industries like manufacturing and finance, supported by regulatory frameworks encouraging innovation.

South Korea : Tech-Driven Business Environment

South Korea holds a 4.0% share of the APAC SaaS market, valued at about $4 billion. The growth is fueled by high internet penetration, a strong focus on R&D, and government support for tech innovation. Demand for SaaS solutions is particularly strong in sectors like gaming, finance, and education. The competitive landscape features major players like Samsung and LG, alongside international firms, creating a vibrant business environment.

Malaysia : Strategic Location and Development

Malaysia's SaaS market represents 2.5% of the APAC share, valued at around $2.5 billion. Growth drivers include a strategic location for regional businesses, increasing digital transformation initiatives, and government support through the Malaysia Digital Economy Corporation. Demand is rising in sectors like logistics and e-commerce, with local players gaining traction alongside global giants like Microsoft and Salesforce.

Thailand : Digital Transformation Initiatives

Thailand's SaaS market captures 1.5% of the APAC share, valued at approximately $1.5 billion. Key growth drivers include government initiatives promoting digital economy strategies and increasing adoption of cloud technologies across various sectors. Demand is particularly strong in tourism and retail, with Bangkok emerging as a key market. The competitive landscape features both local startups and established international players.

Indonesia : Youthful Market and Digital Growth

Indonesia's SaaS market accounts for 1.0% of the APAC share, valued at around $1 billion. The growth is driven by a youthful population, increasing smartphone penetration, and a burgeoning e-commerce sector. Government initiatives like 100 Smart Cities aim to enhance digital infrastructure. Key markets include Jakarta and Surabaya, with local startups gaining ground against established players like Oracle and Salesforce.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC captures a 0.99% share of the SaaS market, valued at approximately $990 million. Growth drivers vary widely, influenced by local economic conditions and digital adoption rates. Countries like Vietnam and the Philippines are witnessing increased SaaS adoption, supported by government initiatives. The competitive landscape is diverse, with both local and international players vying for market share in various sectors.