China : Unmatched Growth and Innovation

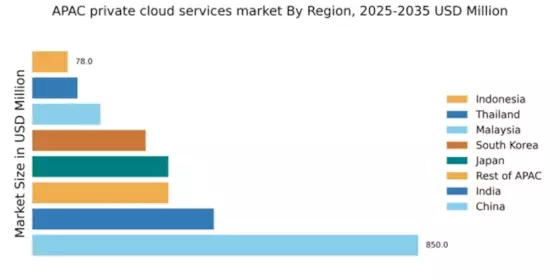

China holds a commanding market share of 42.5% in the APAC private cloud-services sector, valued at $850.0 million. Key growth drivers include rapid digital transformation, government support for cloud adoption, and increasing demand for data security. The Chinese government has implemented favorable policies to encourage cloud infrastructure development, while cities like Beijing and Shanghai are emerging as tech hubs, driving consumption patterns towards hybrid and multi-cloud solutions.

India : Innovation and Investment Surge

India's private cloud market is valued at $400.0 million, capturing 20% of the APAC share. The growth is fueled by increasing internet penetration, a burgeoning startup ecosystem, and significant investments in IT infrastructure. Government initiatives like Digital India are promoting cloud adoption across sectors, while demand for scalable solutions is rising among SMEs and large enterprises alike, reflecting a shift towards cloud-first strategies.

Japan : Focus on Security and Compliance

Japan's private cloud market is valued at $300.0 million, representing 15% of the APAC market. The growth is driven by stringent data protection regulations and a strong emphasis on cybersecurity. Companies are increasingly adopting cloud solutions to comply with local laws while enhancing operational efficiency. The government is also promoting cloud services through initiatives aimed at digital transformation in various industries, including finance and healthcare.

South Korea : Innovation Meets Regulation

South Korea's private cloud market is valued at $250.0 million, accounting for 12.5% of the APAC share. The growth is propelled by high internet speeds, a tech-savvy population, and government support for digital innovation. The Korean government has introduced policies to enhance cloud infrastructure, particularly in cities like Seoul and Busan, where demand for cloud services is surging across sectors such as gaming and e-commerce.

Malaysia : Strategic Growth and Development

Malaysia's private cloud market is valued at $150.0 million, capturing 7.5% of the APAC market. The growth is driven by increasing digitalization across industries and government initiatives like the Malaysia Digital Economy Blueprint. Key cities such as Kuala Lumpur are becoming focal points for cloud adoption, with local enterprises seeking scalable solutions to enhance operational efficiency and competitiveness in the ASEAN region.

Thailand : Government Support and Investment

Thailand's private cloud market is valued at $100.0 million, representing 5% of the APAC share. The growth is supported by government initiatives aimed at boosting the digital economy and increasing investments in IT infrastructure. Cities like Bangkok are witnessing a surge in cloud adoption, particularly among SMEs looking to leverage technology for business growth. The competitive landscape includes both local and international players.

Indonesia : Untapped Market Opportunities

Indonesia's private cloud market is valued at $78.0 million, accounting for 3.9% of the APAC market. The growth is driven by increasing internet penetration and a young, tech-savvy population. Government initiatives to promote digital transformation are also playing a crucial role. Key cities like Jakarta are emerging as hotspots for cloud services, with local businesses increasingly adopting cloud solutions to enhance operational efficiency and scalability.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC private cloud market is valued at $300.0 million, representing 15% of the overall market. This segment includes various countries with differing levels of cloud adoption and regulatory environments. Growth drivers include increasing digital transformation initiatives and investments in IT infrastructure. Countries like Vietnam and the Philippines are witnessing rising demand for cloud services, particularly in sectors like finance and education.