China : Leading in Renewable Energy Solutions

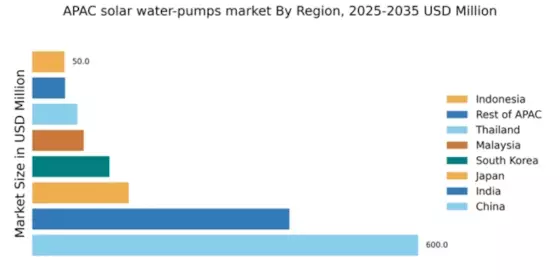

China holds a commanding market share of 600.0, accounting for approximately 50% of the APAC solar water-pump market. Key growth drivers include government incentives for renewable energy, increasing agricultural demand, and urbanization. The Chinese government has implemented policies to promote solar energy, including subsidies and tax breaks for solar installations. Infrastructure development, particularly in rural areas, is also enhancing access to solar technologies.

India : Transforming Agricultural Practices

India's solar water-pump market is valued at 400.0, representing about 33% of the APAC market. The growth is driven by rising energy costs, government initiatives like the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM), and increasing awareness of sustainable practices. Demand is particularly high in states like Maharashtra and Gujarat, where agriculture is heavily reliant on irrigation.

Japan : Focus on Technological Advancements

Japan's solar water-pump market is valued at 150.0, contributing around 12.5% to the APAC total. The market is driven by technological innovation and a strong commitment to renewable energy. Government policies support solar energy through feed-in tariffs and research grants. Urban areas like Tokyo and Osaka are seeing increased adoption of solar technologies, particularly in residential applications.

South Korea : Government Support for Solar Growth

South Korea's market is valued at 120.0, making up about 10% of the APAC market. Key growth drivers include government policies promoting renewable energy and technological advancements in solar technology. The Korean government has set ambitious targets for solar energy adoption, which is reflected in the increasing demand for solar water pumps, especially in regions like Gyeonggi-do and Jeollanam-do.

Malaysia : Government Policies Driving Adoption

Malaysia's solar water-pump market is valued at 80.0, representing about 6.7% of the APAC market. The growth is fueled by government initiatives aimed at increasing renewable energy usage and reducing carbon emissions. Demand is particularly strong in rural areas where access to clean water is critical. The competitive landscape includes local players and international firms like Grundfos and Luminous Power Technologies.

Thailand : Focus on Agricultural Applications

Thailand's market is valued at 70.0, accounting for approximately 5.8% of the APAC total. The growth is driven by increasing agricultural needs and government support for renewable energy projects. Key regions include the Central Plains, where agriculture is predominant. Major players like Shakti Pumps are establishing a strong presence, catering to the local demand for solar water solutions.

Indonesia : Rural Electrification Initiatives

Indonesia's solar water-pump market is valued at 50.0, representing about 4.2% of the APAC market. The growth is driven by rural electrification initiatives and increasing awareness of renewable energy benefits. Key regions include Java and Bali, where agricultural practices are evolving. The competitive landscape is emerging, with local and international players like Franklin Electric entering the market.

Rest of APAC : Regional Variations in Demand

The Rest of APAC market is valued at 51.05, contributing around 4.2% to the overall market. This sub-region includes various countries with differing levels of solar adoption. Growth drivers include local government initiatives and varying agricultural needs. The competitive landscape is fragmented, with both local and international players vying for market share. Applications range from agricultural irrigation to residential use.