China : Unmatched Growth and Infrastructure Development

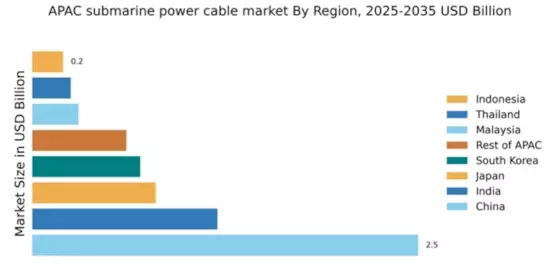

China holds a commanding market share of 2.5 in the submarine power-cable sector, driven by rapid industrialization and a robust push for renewable energy. The government's initiatives, such as the 14th Five-Year Plan, emphasize the expansion of offshore wind farms and grid interconnections, fueling demand for submarine cables. Additionally, the increasing consumption of electricity in urban areas and the need for reliable energy transmission are pivotal growth drivers.

India : Strong Demand from Renewable Sector

India's submarine power-cable market is valued at 1.2, reflecting significant growth potential. The government's focus on renewable energy, particularly offshore wind and solar projects, is a key driver of demand. Regulatory frameworks, such as the National Offshore Wind Energy Policy, are facilitating investments in this sector. The increasing need for reliable power supply in coastal regions further boosts consumption patterns.

Japan : Focus on Advanced Cable Solutions

Japan's market share stands at 0.8, characterized by a strong emphasis on technological innovation. The government is investing in advanced submarine cable technologies to enhance energy efficiency and reliability. Demand is driven by the need for energy security and the integration of renewable sources. Regulatory support for offshore wind projects is also a significant factor influencing market dynamics.

South Korea : Growing Demand for Energy Solutions

South Korea's submarine power-cable market is valued at 0.7, with strategic investments in energy infrastructure. The government's Green New Deal aims to increase renewable energy capacity, driving demand for submarine cables. Key cities like Busan and Incheon are pivotal markets, with ongoing projects in offshore wind energy. The competitive landscape includes major players like LS Cable & System and ABB.

Malaysia : Focus on Regional Connectivity Projects

Malaysia's submarine power-cable market is valued at 0.3, with growth driven by regional connectivity initiatives. The government is promoting investments in infrastructure to enhance energy transmission capabilities. Demand is rising in coastal areas, particularly in Penang and Johor, where industrial activities are concentrated. The market is competitive, with players like Nexans and Prysmian Group establishing a presence.

Thailand : Investment in Renewable Energy Projects

Thailand's submarine power-cable market is valued at 0.25, with increasing investments in renewable energy projects. The government's commitment to the Power Development Plan emphasizes the need for reliable energy transmission. Key markets include Bangkok and Chonburi, where industrial growth is prominent. The competitive landscape features both local and international players, enhancing market dynamics.

Indonesia : Focus on Energy Access and Reliability

Indonesia's submarine power-cable market is valued at 0.2, driven by the need for improved energy access in remote areas. The government's initiatives to enhance electricity distribution are pivotal growth drivers. Key regions include Java and Sumatra, where industrial activities are concentrated. The market is competitive, with local and international players vying for market share.

Rest of APAC : Varied Market Dynamics Across Regions

The Rest of APAC market for submarine power cables is valued at 0.61, showcasing diverse opportunities across various countries. Growth is driven by regional energy demands and infrastructure development. Countries like Vietnam and the Philippines are emerging markets, with increasing investments in renewable energy. The competitive landscape includes both established players and new entrants, enhancing market dynamics.