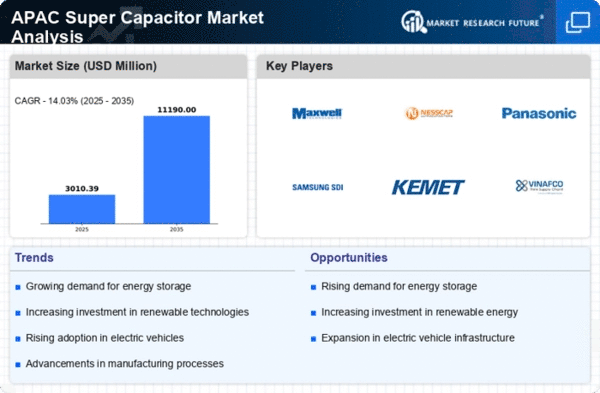

Growing Energy Storage Needs

The increasing demand for energy storage solutions in APAC is a pivotal driver for the super capacitor market. As urbanization accelerates and energy consumption rises, the need for efficient energy storage systems becomes paramount. Super capacitors, with their rapid charge and discharge capabilities, are well-suited for applications in renewable energy integration and electric vehicles. The market for energy storage in APAC is projected to reach approximately $20 billion by 2026, indicating a robust growth trajectory. This trend is further fueled by government initiatives aimed at promoting sustainable energy practices, thereby enhancing the adoption of super capacitors in various sectors. Consequently, the super capacitor market is likely to experience significant growth as it aligns with the broader energy storage demands across the region.

Supportive Government Policies

Government policies in APAC are increasingly favoring the adoption of advanced energy storage technologies, including super capacitors. Initiatives aimed at reducing carbon emissions and promoting renewable energy sources are driving investments in this sector. For instance, several countries in APAC have introduced subsidies and incentives for companies that utilize super capacitors in their products. This regulatory support is expected to bolster the super capacitor market, as manufacturers are encouraged to innovate and integrate these technologies into their offerings. Furthermore, the commitment to achieving net-zero emissions by 2050 in many APAC nations suggests a sustained focus on energy-efficient solutions, which could further enhance the market landscape for super capacitors.

Rising Adoption in Consumer Electronics

The consumer electronics sector in APAC is witnessing a notable shift towards the incorporation of super capacitors, driven by the need for compact and efficient energy storage solutions. With the proliferation of portable devices, such as smartphones and wearables, manufacturers are increasingly seeking alternatives to traditional batteries. Super capacitors offer advantages such as longer life cycles and faster charging times, making them an attractive option. The consumer electronics market in APAC is expected to grow at a CAGR of around 8% through 2025, which could significantly impact the super capacitor market. As consumer preferences evolve towards more sustainable and efficient products, the demand for super capacitors is likely to rise, further solidifying their role in this dynamic market.

Increasing Focus on Sustainable Solutions

The super capacitor market is experiencing a surge in interest due to the growing emphasis on sustainability in APAC. As environmental concerns become more pronounced, industries are seeking energy storage solutions that minimize ecological impact. Super capacitors, known for their environmentally friendly characteristics, are gaining traction as a viable alternative to conventional batteries. The shift towards sustainable practices is evident in various sectors, including transportation and renewable energy, where super capacitors are being integrated to enhance efficiency and reduce waste. This trend is likely to drive the super capacitor market forward, as companies align their strategies with sustainability goals, thereby fostering a more eco-conscious approach to energy storage.

Technological Innovations in Manufacturing

Technological advancements in the manufacturing processes of super capacitors are enhancing their performance and reducing production costs. Innovations such as the development of new materials and improved fabrication techniques are enabling manufacturers in APAC to produce super capacitors that are more efficient and cost-effective. This trend is crucial for the super capacitor market, as it allows for greater scalability and accessibility of these energy storage solutions. As production costs decrease, the potential for widespread adoption across various applications, including automotive and industrial sectors, increases. The ongoing research and development efforts in this area suggest a promising future for the super capacitor market, as manufacturers strive to meet the growing demand for high-performance energy storage solutions.