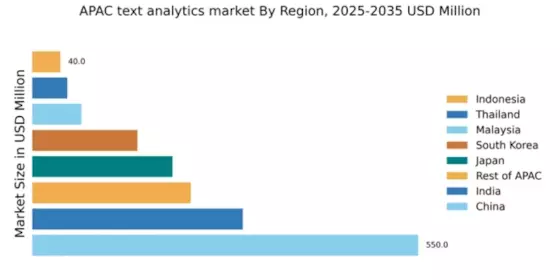

China : Unmatched Growth and Innovation

China holds a commanding market share of 45.6% in the APAC text analytics market, valued at $550.0 million. Key growth drivers include rapid digital transformation, increasing data generation, and government initiatives promoting AI and big data. The demand for advanced analytics solutions is surging, particularly in sectors like e-commerce and finance. Regulatory support, such as the New Generation Artificial Intelligence Development Plan, is fostering a conducive environment for innovation and infrastructure development.

India : Innovation Meets Demand in India

India's text analytics market is valued at $300.0 million, capturing 24.8% of the APAC share. The growth is fueled by the increasing adoption of cloud computing and AI technologies across various sectors. Demand is particularly high in IT, healthcare, and retail, driven by a burgeoning startup ecosystem. Government initiatives like Digital India are enhancing digital infrastructure, promoting data-driven decision-making, and encouraging investments in analytics solutions.

Japan : Precision and Quality Drive Growth

Japan's text analytics market is valued at $200.0 million, representing 16.5% of the APAC market. The growth is propelled by the country's focus on technological innovation and high-quality data analytics. Industries such as automotive, healthcare, and finance are increasingly leveraging text analytics for improved customer insights and operational efficiency. Government policies promoting digital transformation and smart cities are further enhancing the market landscape.

South Korea : Strong Demand in Diverse Sectors

South Korea's text analytics market is valued at $150.0 million, accounting for 12.4% of the APAC share. The growth is driven by the increasing use of big data and AI technologies across sectors like telecommunications, finance, and retail. The government is actively supporting digital innovation through initiatives like the Korean New Deal, which aims to boost the digital economy. This has led to a favorable business environment for analytics solutions.

Malaysia : Strategic Location for Analytics Growth

Malaysia's text analytics market is valued at $70.0 million, capturing 5.8% of the APAC market. The growth is supported by the increasing demand for data-driven insights in sectors like finance, healthcare, and e-commerce. Government initiatives such as the Malaysia Digital Economy Corporation (MDEC) are promoting the adoption of digital technologies. The country's strategic location in Southeast Asia also enhances its appeal as a regional analytics hub.

Thailand : Diverse Applications Drive Growth

Thailand's text analytics market is valued at $50.0 million, representing 4.1% of the APAC share. The growth is driven by the increasing adoption of digital technologies in sectors like tourism, retail, and finance. Government initiatives aimed at enhancing the digital economy are fostering a supportive environment for analytics solutions. The demand for customer insights and operational efficiency is pushing businesses to invest in text analytics.

Indonesia : Rapid Digital Transformation Ahead

Indonesia's text analytics market is valued at $40.0 million, accounting for 3.3% of the APAC market. The growth is driven by the rapid digital transformation across various sectors, including e-commerce and telecommunications. Government initiatives like 100 Smart Cities are promoting the use of data analytics for urban development. The competitive landscape is evolving, with local startups and The text analytics market share.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC text analytics market is valued at $226.0 million, capturing 18.6% of the overall market. Growth is driven by varying demand across countries, influenced by local industries and digital adoption rates. Countries like Vietnam and the Philippines are emerging markets with increasing investments in analytics. The competitive landscape features both local and international players, creating a dynamic business environment for text analytics solutions.