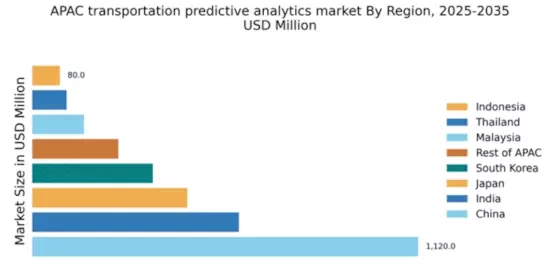

China : Unmatched Growth and Innovation

China holds a commanding market share of 44% in the transportation predictive-analytics sector, valued at $1,120.0 million. Key growth drivers include rapid urbanization, government investments in smart transportation, and increasing demand for data-driven decision-making. Regulatory policies favoring technological advancements and infrastructure development, such as the Belt and Road Initiative, further bolster market growth. The rise in e-commerce and logistics demands also fuels consumption patterns, pushing for enhanced predictive analytics solutions.

India : Transforming Transportation with Data

India's market share stands at 24% with a value of $600.0 million, driven by a burgeoning digital economy and government initiatives like the National Logistics Policy. The demand for predictive analytics is surging, particularly in urban areas, as cities like Bengaluru and Mumbai invest in smart infrastructure. The competitive landscape features major players like IBM and SAP, who are adapting their solutions to local needs, enhancing the business environment for analytics applications in transportation and logistics.

Japan : Innovative Solutions for Efficiency

Japan's transportation predictive-analytics market is valued at $450.0 million, accounting for 18% of the APAC share. The country benefits from advanced technology adoption and a strong focus on automation in logistics. Government initiatives promoting smart city projects and sustainable transport solutions are key growth drivers. The demand for real-time data analytics is increasing, particularly in urban centers like Tokyo and Osaka, where traffic congestion is a major concern.

South Korea : Leading in Data-Driven Solutions

South Korea's market is valued at $350.0 million, representing 14% of the APAC market. The country is witnessing a surge in demand for predictive analytics, driven by government policies supporting smart transportation and urban mobility. Cities like Seoul are investing heavily in data infrastructure to enhance public transport efficiency. Major players like Microsoft and TIBCO Software are actively participating in this market, providing tailored solutions for local needs.

Malaysia : Growth in Smart Infrastructure

Malaysia's transportation predictive-analytics market is valued at $150.0 million, capturing 6% of the APAC share. The growth is fueled by government initiatives aimed at enhancing public transport systems and urban planning. Demand for predictive analytics is rising, particularly in Kuala Lumpur, where smart city projects are underway. The competitive landscape includes local firms and international players like Oracle, who are adapting their offerings to meet local market dynamics.

Thailand : Focus on Urban Mobility Solutions

Thailand's market is valued at $100.0 million, accounting for 4% of the APAC market. The growth is driven by increasing urbanization and government support for smart transport initiatives. Cities like Bangkok are focusing on improving traffic management through predictive analytics. The competitive landscape features both local startups and established players like SAS Institute, who are providing innovative solutions tailored to the Thai market.

Indonesia : Transforming Transportation Sector

Indonesia's market is valued at $80.0 million, representing 3% of the APAC share. The growth is driven by rapid urbanization and increasing investments in transportation infrastructure. Jakarta is a key market, where the government is implementing smart city initiatives. The competitive landscape includes both local and international players, with a focus on enhancing logistics and public transport efficiency through predictive analytics solutions.

Rest of APAC : Varied Market Dynamics Across Regions

The Rest of APAC market is valued at $250.0 million, capturing 10% of the overall market. This segment includes a mix of developed and developing economies, each with unique growth drivers. Demand for predictive analytics is rising across various sectors, including logistics and public transport. The competitive landscape is diverse, featuring both local and international players adapting to regional needs and regulatory environments.