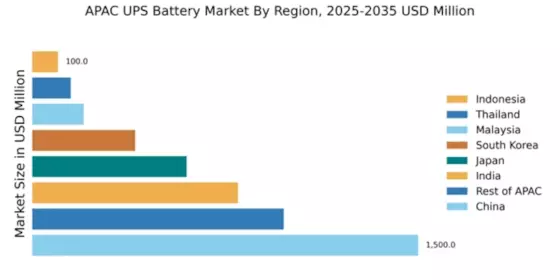

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 38.5% in the APAC UPS battery market, valued at $1500.0 million. Key growth drivers include rapid industrialization, increasing data center investments, and a surge in e-commerce. Government initiatives promoting renewable energy and stringent regulations on power quality are further fueling demand. The country's robust infrastructure development, particularly in urban areas, supports the growing need for reliable power solutions.

India : Evolving Market with Diverse Applications

India accounts for 20.5% of the APAC UPS battery market, valued at $800.0 million. The growth is driven by expanding IT and telecommunications sectors, alongside increasing power outages. Government initiatives like 'Make in India' and investments in smart grid technology are enhancing market prospects. The demand for UPS systems is also rising in healthcare and manufacturing sectors, reflecting a shift towards more reliable power solutions.

Japan : Innovation Driving Market Growth

Japan holds a 15.4% market share in the APAC UPS battery sector, valued at $600.0 million. The market is propelled by technological advancements and a focus on energy efficiency. Government policies promoting green technology and disaster preparedness are significant growth factors. The demand for UPS systems is particularly strong in urban centers like Tokyo and Osaka, where infrastructure reliability is critical.

South Korea : Strong Industrial Base and Demand

South Korea represents 10.3% of the APAC UPS battery market, valued at $400.0 million. The growth is driven by a strong industrial base, particularly in electronics and manufacturing. Government support for renewable energy and smart city initiatives is enhancing market dynamics. Key cities like Seoul and Busan are witnessing increased demand for UPS systems, especially in data centers and healthcare facilities.

Malaysia : Growing Demand in Key Sectors

Malaysia accounts for 5.1% of the APAC UPS battery market, valued at $200.0 million. The growth is fueled by increasing investments in infrastructure and a rising number of data centers. Government initiatives aimed at enhancing energy efficiency and sustainability are also contributing to market expansion. The demand for UPS systems is particularly strong in Kuala Lumpur and Penang, where industrial activities are concentrated.

Thailand : Infrastructure Development Boosting Demand

Thailand holds a 3.8% market share in the APAC UPS battery market, valued at $150.0 million. The growth is driven by infrastructure development and increasing power reliability needs. Government policies supporting renewable energy and energy efficiency are enhancing market conditions. Key markets include Bangkok and Chiang Mai, where demand for UPS systems is rising in sectors like telecommunications and healthcare.

Indonesia : Rising Demand Amidst Challenges

Indonesia represents 2.5% of the APAC UPS battery market, valued at $100.0 million. The market is growing due to increasing urbanization and a rising number of businesses requiring reliable power solutions. Government initiatives aimed at improving energy access and infrastructure are crucial for market development. Key cities like Jakarta and Surabaya are seeing heightened demand for UPS systems, particularly in retail and telecommunications.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for 25.5% of the UPS battery market, valued at $977.31 million. Growth is driven by varying industrial needs and increasing energy demands across different countries. Government policies promoting energy efficiency and sustainability are influencing market dynamics. Key markets include Vietnam and the Philippines, where demand for UPS systems is rising in sectors like manufacturing and IT.