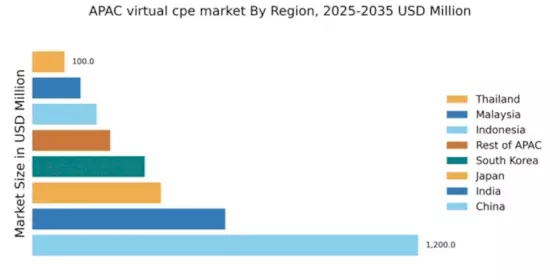

China : Unmatched Growth and Innovation

China holds a commanding market share of 48.5% in the APAC virtual CPE market, valued at $1200.0 million. Key growth drivers include rapid digital transformation, increased demand for cloud services, and government initiatives promoting smart city projects. The regulatory environment is supportive, with policies aimed at enhancing telecommunications infrastructure and fostering innovation in technology sectors. The industrial development is robust, with significant investments in 5G and IoT technologies.

India : A Booming Market for Innovation

Key markets include major cities like Bangalore, Mumbai, and Delhi, where tech hubs are thriving. The competitive landscape features significant players like Cisco and VMware, alongside local startups. The business environment is dynamic, with a focus on sectors such as fintech, e-commerce, and telecommunications, driving demand for virtual CPE solutions.

Japan : Innovation at the Forefront

Key markets include Tokyo and Osaka, where major tech companies are based. The competitive landscape is characterized by strong players like Nokia and Juniper Networks, alongside local firms. The business environment is stable, with a focus on sectors such as manufacturing, finance, and healthcare, which are increasingly adopting virtual CPE solutions.

South Korea : Leading in Digital Transformation

Key markets include Seoul and Busan, where major telecommunications companies operate. The competitive landscape features significant players like Arista Networks and Cisco, with a focus on sectors such as gaming, e-commerce, and smart cities. The business environment is vibrant, with a strong emphasis on technology adoption and digital solutions.

Malaysia : Strategic Investments in Technology

Key markets include Kuala Lumpur and Penang, where tech startups are emerging. The competitive landscape features players like VMware and local firms. The business environment is evolving, with a focus on sectors such as finance, logistics, and education, which are increasingly adopting virtual CPE technologies.

Thailand : Adapting to Market Needs

Key markets include Bangkok and Chiang Mai, where digital services are expanding. The competitive landscape features players like Cisco and local providers. The business environment is improving, with a focus on sectors such as tourism, retail, and telecommunications, which are increasingly adopting virtual CPE solutions.

Indonesia : Market on the Rise

Key markets include Jakarta and Surabaya, where demand for digital solutions is high. The competitive landscape features players like ZTE and local firms. The business environment is dynamic, with a focus on sectors such as e-commerce, fintech, and telecommunications, driving the adoption of virtual CPE technologies.

Rest of APAC : Varied Growth Across Regions

Key markets include Vietnam, Philippines, and Singapore, each with unique market dynamics. The competitive landscape features a mix of global players and local firms. The business environment is diverse, with sectors such as retail, finance, and telecommunications increasingly adopting virtual CPE solutions.