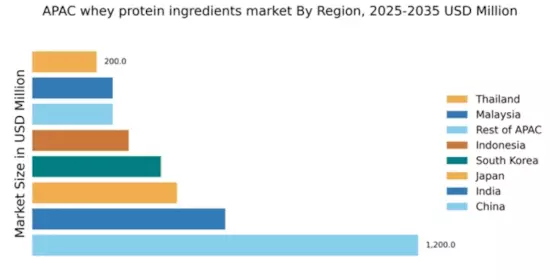

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 48% in the APAC whey protein-ingredients market, valued at $1200.0 million. Key growth drivers include a rising health consciousness among consumers, increasing disposable incomes, and a booming fitness culture. Demand for whey protein is particularly strong in urban areas, driven by the popularity of protein supplements and functional foods. Government initiatives promoting health and nutrition further bolster market growth, alongside significant investments in food processing infrastructure.

India : Emerging Market with Strong Potential

India accounts for 15% of the APAC whey protein market, valued at $600.0 million. The growth is fueled by increasing awareness of health and fitness, particularly among the youth. Demand for whey protein is rising in urban centers like Mumbai and Delhi, where fitness trends are gaining traction. Regulatory support for health supplements and a growing e-commerce sector are also contributing to market expansion, alongside improvements in logistics and distribution networks.

Japan : Quality and Tradition Drive Demand

Japan holds a 12% market share in the APAC whey protein sector, valued at $450.0 million. The market is driven by a strong preference for high-quality, functional food products, with consumers increasingly seeking health benefits. Traditional dietary habits are evolving, leading to higher consumption of protein supplements. Regulatory frameworks support health claims on food products, enhancing consumer trust and market growth, while advanced food technology plays a crucial role in product innovation.

South Korea : Fitness Culture Fuels Protein Demand

South Korea represents 11% of the APAC whey protein market, valued at $400.0 million. The surge in health and fitness awareness, particularly among millennials, is a key growth driver. Urban areas like Seoul are witnessing a boom in protein supplement consumption, supported by government initiatives promoting healthy lifestyles. The competitive landscape features major players like Abbott Laboratories and Danone, with a focus on innovative product offerings tailored to local tastes.

Malaysia : Health Trends Reshape Consumption Patterns

Malaysia captures 6% of the APAC whey protein market, valued at $250.0 million. The growth is driven by increasing health awareness and a shift towards protein-rich diets. Urban centers such as Kuala Lumpur are key markets, with rising demand for whey protein in sports nutrition and functional foods. Regulatory support for health supplements and improvements in distribution channels are enhancing market accessibility, while local players are increasingly innovating to meet consumer preferences.

Thailand : Health and Wellness Trends Emerge

Thailand holds a 5% market share in the APAC whey protein market, valued at $200.0 million. The market is experiencing growth due to rising health consciousness and a burgeoning fitness culture. Key cities like Bangkok are seeing increased demand for whey protein in both dietary supplements and food products. The competitive landscape includes both local and international players, with a focus on product innovation and marketing strategies that resonate with health-focused consumers.

Indonesia : Health Awareness Drives Protein Consumption

Indonesia accounts for 8% of the APAC whey protein market, valued at $300.0 million. The growth is driven by increasing health awareness and a growing middle class. Urban areas such as Jakarta are key markets, with rising demand for whey protein in various applications, including sports nutrition and functional foods. The competitive landscape features both local and international brands, with a focus on affordability and accessibility to cater to diverse consumer needs.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC captures 6% of the whey protein market, valued at $250.0 million. This segment includes a mix of emerging markets with varying growth rates driven by local health trends and dietary preferences. Countries like Vietnam and the Philippines are witnessing increased demand for whey protein, supported by rising disposable incomes and health awareness. The competitive landscape is characterized by a mix of local and international players, focusing on tailored product offerings to meet regional tastes.

.png)