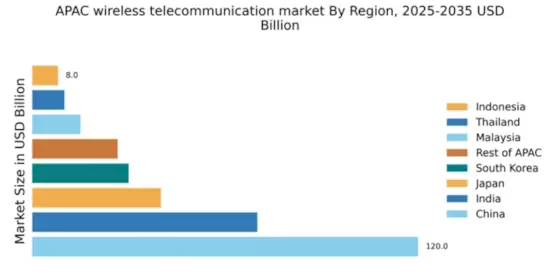

China : Unmatched Growth and Innovation

China holds a commanding market share of 120.0, representing a significant portion of the APAC wireless telecommunication sector. Key growth drivers include rapid urbanization, increasing smartphone penetration, and government initiatives promoting 5G technology. Demand trends show a shift towards high-speed internet and IoT applications, supported by robust infrastructure development and favorable regulatory policies aimed at enhancing connectivity across urban and rural areas.

India : Emerging Market with High Demand

India's wireless telecommunication market is valued at 70.0, driven by a young population and increasing mobile data consumption. The government's Digital India initiative fosters growth by enhancing digital infrastructure and promoting affordable internet access. Demand for mobile services is surging, particularly in urban areas, as consumers shift towards data-centric applications and services, supported by competitive pricing strategies from local providers.

Japan : Mature Market with Unique Trends

Japan's market share stands at 40.0, characterized by advanced technology adoption and high consumer expectations. Key growth drivers include the integration of AI and IoT in telecommunications, alongside government support for digital transformation. The demand for high-speed internet and innovative services is prevalent, with regulatory frameworks encouraging competition and investment in next-gen technologies.

South Korea : Pioneering Wireless Technology Adoption

South Korea's wireless market is valued at 30.0, with a strong emphasis on 5G technology and smart city initiatives. The government's proactive policies and investments in telecommunications infrastructure have spurred growth. Demand for high-speed mobile services is robust, particularly in metropolitan areas like Seoul, where competition among major players drives innovation and service quality.

Malaysia : Emerging Market with Potential

Malaysia's wireless telecommunication market is valued at 15.0, with increasing smartphone adoption and mobile internet usage. Government initiatives, such as the National Digital Economy Framework, aim to enhance connectivity and digital services. Demand trends indicate a shift towards mobile data services, with urban centers like Kuala Lumpur leading in consumption patterns and competitive offerings from local providers.

Thailand : Market Growth Driven by Innovation

Thailand's market share is 10.0, with a growing focus on digital transformation and mobile services. The government's Thailand 4.0 initiative promotes innovation and investment in telecommunications infrastructure. Demand for mobile data is increasing, particularly in urban areas like Bangkok, where competition among major players fosters service improvements and customer engagement.

Indonesia : Rapid Growth in Mobile Services

Indonesia's wireless telecommunication market is valued at 8.0, driven by a large population and increasing mobile penetration. Government policies aimed at enhancing digital infrastructure support growth, while demand for mobile data services is on the rise. Key urban areas like Jakarta are pivotal markets, with local and international players competing to capture the expanding consumer base.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC market is valued at 26.57, encompassing a diverse range of countries with varying levels of telecommunications development. Growth drivers include increasing mobile penetration and government initiatives to improve connectivity. Demand trends vary significantly, influenced by local market conditions and regulatory environments, creating unique challenges and opportunities for service providers.