Increased Mobile App Usage

The App Analytics Market is significantly influenced by the rising usage of mobile applications across various sectors. With the proliferation of smartphones and tablets, users are increasingly engaging with apps for diverse purposes, from shopping to social networking. Recent statistics indicate that mobile app downloads have surpassed 200 billion annually, underscoring the growing reliance on mobile technology. This trend compels businesses to invest in app analytics solutions to monitor user behavior, track engagement metrics, and identify areas for improvement. As the number of mobile applications continues to escalate, the demand for sophisticated analytics tools that can provide insights into user interactions is likely to intensify, further propelling the growth of the App Analytics Market.

Adoption of Cloud-Based Solutions

The App Analytics Market is witnessing a shift towards cloud-based analytics solutions, which offer scalability and flexibility for businesses. As organizations increasingly migrate their operations to the cloud, the demand for cloud-based app analytics tools is on the rise. These solutions enable companies to access real-time data and insights from anywhere, facilitating better decision-making processes. Market Research Future suggests that the cloud segment is expected to capture a significant share of the app analytics market, driven by the need for cost-effective and efficient data management. Furthermore, the ability to integrate cloud analytics with other business applications enhances the overall functionality and usability of app analytics tools, making them indispensable for modern enterprises. This trend indicates a transformative phase for the App Analytics Market as cloud adoption continues to grow.

Focus on Customer Experience Enhancement

The App Analytics Market is increasingly focused on enhancing customer experience, which has become a critical differentiator for businesses. Companies are leveraging app analytics to gain insights into user preferences and behaviors, allowing them to tailor their offerings accordingly. Research indicates that organizations that prioritize customer experience are likely to see a 10-15% increase in customer loyalty and retention rates. By utilizing analytics tools, businesses can identify pain points in the user journey and implement targeted improvements, thereby fostering a more engaging and satisfying experience. This emphasis on customer-centric strategies is driving the demand for advanced app analytics solutions, as companies strive to create personalized experiences that resonate with their users. As a result, the App Analytics Market is evolving to meet these growing expectations.

Regulatory Compliance and Data Governance

The App Analytics Market is increasingly shaped by the need for regulatory compliance and robust data governance frameworks. As data privacy regulations become more stringent, businesses are compelled to adopt analytics solutions that ensure compliance with legal standards. This trend is particularly evident in regions where data protection laws are being enforced more rigorously. Companies are investing in app analytics tools that not only provide insights but also adhere to data governance protocols, thereby mitigating risks associated with data breaches and non-compliance. The market is likely to see a rise in demand for analytics solutions that incorporate features for data security and privacy management. Consequently, the App Analytics Market is adapting to these regulatory challenges, positioning itself as a critical component in the broader landscape of data management and compliance.

Rising Demand for Data-Driven Decision Making

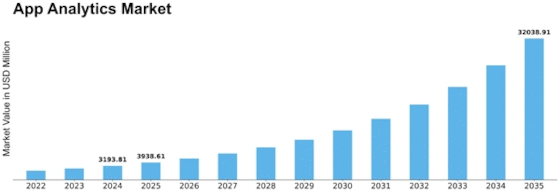

The App Analytics Market is experiencing a notable surge in demand for data-driven decision making. Organizations are increasingly recognizing the value of leveraging analytics to enhance user engagement and optimize app performance. According to recent estimates, the market for app analytics is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is largely attributed to businesses seeking to harness actionable insights from user data, thereby improving their overall strategic initiatives. As companies strive to remain competitive, the integration of robust analytics tools becomes essential, enabling them to make informed decisions that drive user retention and satisfaction. Consequently, the App Analytics Market is poised for substantial expansion as more enterprises adopt data-centric approaches.

Leave a Comment