Top Industry Leaders in the AR VR Aviation Market

Strategies Adopted:

Product Development: Key players invest in developing AR/VR hardware and software solutions tailored to aviation applications, focusing on realism, usability, and interoperability.

Partnership and Collaboration: Collaboration with airlines, aircraft manufacturers, training centers, and technology providers helps companies expand market reach and develop integrated AR/VR solutions.

Training and Simulation: Companies offer AR/VR training and simulation solutions for pilots, maintenance technicians, and ground crews, providing immersive and realistic training experiences.

Integration with Existing Systems: Integration of AR/VR technologies with existing aviation systems, such as flight simulators, maintenance platforms, and cockpit displays, enhances functionality and usability.

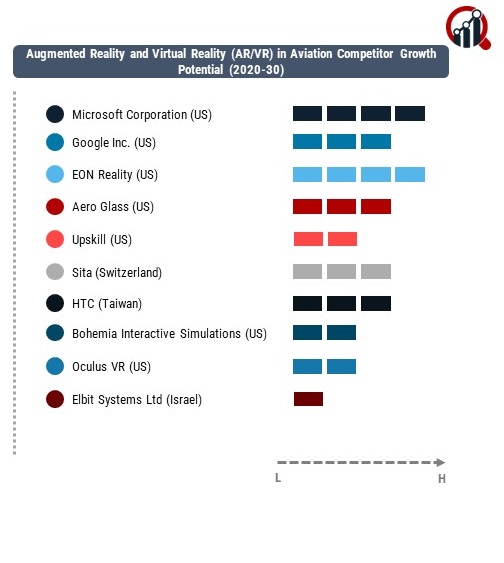

Competitive Intensity Within The Industry::

Microsoft Corporation (US)

Google Inc. (US)

EON Reality (US)

Aero Glass (US)

Upskill (US)

Sita (Switzerland)

HTC (Taiwan)

Bohemia Interactive Simulations (US)

Oculus VR (US)

Elbit Systems Ltd (Israel)

HoneyWell International Inc. (US)

Sony (Japan)

IBM Corporation (US)

Factors for Market Share Analysis:

Technology Leadership: Market share analysis considers companies' technological expertise, innovation capabilities, and investment in AR/VR research and development.

Industry Partnerships: Strategic partnerships and collaborations with aviation stakeholders influence market share by facilitating access to customers, resources, and expertise.

Customer Satisfaction: Market share is influenced by customer satisfaction and loyalty, based on factors such as product quality, performance, support, and cost-effectiveness.

New and Emerging Companies:

Varjo Technologies: Varjo specializes in high-fidelity VR headsets for professional use, offering immersive and realistic experiences for aviation training and simulation.

Magic Leap: Magic Leap develops spatial computing platforms and AR glasses, enabling immersive and interactive AR experiences for aviation applications such as maintenance and inspection.

Aero Glass: Aero Glass provides AR solutions for aviation navigation and situational awareness, enhancing pilot visibility and safety during flight operations.

Industry News and Current Trends:

Remote Assistance: AR/VR technologies are increasingly used for remote assistance and maintenance support, enabling technicians to access real-time guidance and troubleshooting instructions from experts.

Digital Twin Adoption: The adoption of digital twin technology, coupled with AR/VR visualization, allows aviation companies to create virtual replicas of aircraft and systems for simulation, analysis, and training purposes.

Regulatory Compliance: Regulatory bodies such as the FAA and EASA are developing guidelines and standards for the use of AR/VR technologies in aviation, ensuring safety, security, and regulatory compliance.

Overall Competitive Scenario:

The AR/VR in aviation market is characterized by intense competition among key players, driven by technological innovation, market demand, and regulatory considerations. Companies differentiate themselves through product development, partnership strategies, and customer satisfaction. New entrants and emerging companies disrupt the market with innovative solutions and business models, challenging established players. Collaboration, innovation, and customer-centricity are critical for companies to maintain competitiveness and drive growth in this dynamic market.

Recent Market Development

The AR/VR solutions in the aerospace and defence sector are projected to reach US$ 5.8 Billion by 2026.

NASA is using AR technology developed by Lockheed Martin to fasten the construction of the Orion spacecraft.