Research Methodology on Aviation Cyber Security Market

The research methodology used for the research report titled Aviation Cyber Security Market is a combination of primary and secondary research. The report offers detailed insights into the global aviation cybersecurity market and has been compiled by experienced professionals in the industry. Primary research involved interviews with stakeholders, which have been conducted at various levels, to fully understand the market and its potential. These people include key opinion leaders at various levels such as technology experts, sector experts, senior executives, trend analysts, technology specialists, and industry consultants. The primary sources were used to identify and collect information for the current scope of the study such as the current market situation, industry plans, key manufacturers and industry trends.

Secondary sources such as the company’s website, regulatory bodies, industry publications, statistical databases, financial reports, trade journals, government and institutional research, press releases, market reports and white papers were used to obtain information as such, information about historic data, current and forecasted information were collected. The company website was used to better understand and confirm the authenticity of information obtained from other secondary sources.

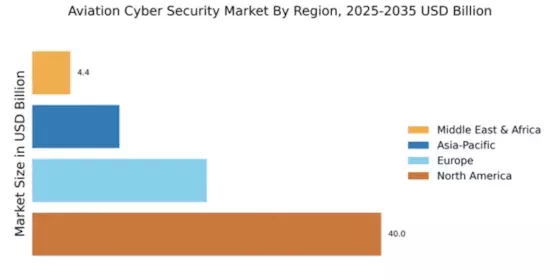

To ascertain an unbiased market estimation, various approaches were used. These approaches include the bottom-up approach, top-down approach, factor analysis, and time-series analysis which were all used with the help of historical data, and demand side as well as supply side data triangulation. The base year considered for the market estimation is 2022. To arrive at the market numbers Market Research Future (MRFR) has analysed the market for Aviation Cyber Security from a global perspective. The market is studied across the regions of North America, Europe, Asia-Pacific, Middle East & Africa and Latin America. All the numbers in the market report were estimated based on the obtained data and analysis of current industry trends.

An in-depth analysis of the market between 2023 and 2030 has been conducted to provide an accurate view of the global aviation cybersecurity market. The key segments across the industry were identified and evaluated for market estimation. In the regional breakdown, current economic and industrial development trends within the region and their impact on the global market were also analyzed. To arrive at the current size of the global aviation cyber security market and future estimations, industry value chain analysis was also conducted. This includes activities such as raw material procurement & end use, raw material resources, and industry distribution chain. Various parameters such as economic forecasting, economic policies, technology advancements, demand & supply, stock & bond markets, consumer behaviour and more, were taken into account during the market estimation process.

To deliver the industry size estimation, market segmentation was done based on component, type, service, and region. This was done to provide exhaustive information on the market and the depths of each segment. Based on components the market was segmented into hardware, software and services. Based on type, the market was segmented into identity access management, anti-malware, encryption, network firewalls, network access control, web application firewalls and others. Based on services, the market was segmented into consulting, integration and others.

Detailed analysis along with qualitative and quantitative information about the market were used to further understand the market dynamics. Detailed interviews and surveys were conducted with the stakeholders and key opinion leaders to gain further insight. The report further considers an entire industry value chain and various associated vendors were interviewed and their opinions were collected for further analysis. Secondary sources such as press releases, industry reports, company reports, and financial reports have been referred to gather pertinent information about the market. Data models used have been verified and validated multiple times through the robust secondary and primary research process.

The report aims to provide the readers with an unbiased opinion on the current aviation cyber security market. The estimation of the market has been conducted by referring to various industry associations. The information collected in the report is reliable and trustworthy. The report follows a rigorous process of data collection and requires several months to complete.

Finally, the information obtained from the different sources was studied and analyzed thoroughly. The data obtained from each source was compared with other sources to ensure credibility and accuracy. This report follows a systematic approach that has been formulated and tested to provide accurate market information and understanding. Finally, the market was appropriately segmented and estimated based on the type, component, service and region.