Market Share

Aviation Cyber Security Market Share Analysis

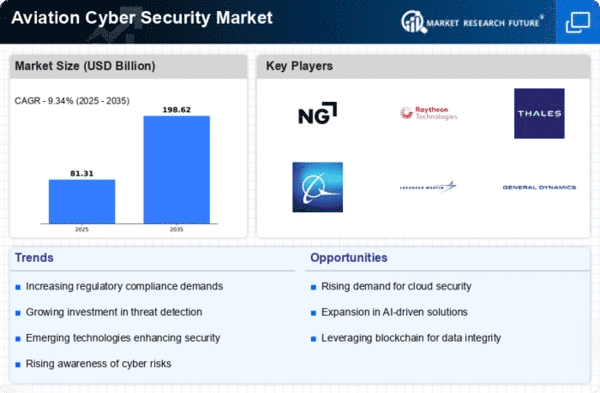

In the competitive arena of the aviation cybersecurity market, companies employ various strategies to position themselves effectively and secure their market share. One pivotal strategy involves specialization and niche offerings. Some companies focus on developing cybersecurity solutions specifically tailored for aviation systems, recognizing the unique challenges and complexities within the industry. By specializing in aviation cybersecurity, they carve out a niche, catering to the specific needs of airlines, airports, aircraft manufacturers, and maintenance providers, thereby establishing a strong presence within this specialized segment of the market. Technological innovation stands as another critical factor in market share positioning strategies within aviation cybersecurity. Companies strive to differentiate themselves by introducing cutting-edge cybersecurity solutions that address the evolving threats facing aviation systems. Innovations such as advanced threat detection algorithms, AI-driven security analytics, predictive modeling, and real-time monitoring capabilities serve as distinguishing factors, attracting customers seeking advanced and adaptive cybersecurity solutions. Moreover, strategic alliances and partnerships play a pivotal role in market share positioning within the aviation cybersecurity sector. Collaborations between cybersecurity firms, aviation industry stakeholders, and government agencies enable the development of integrated and comprehensive cybersecurity solutions. These partnerships foster innovation, bring together diverse expertise, and facilitate the introduction of robust cybersecurity systems tailored specifically for the aviation sector. Service quality and reliability are significant factors influencing market share positioning strategies in aviation cybersecurity. Companies differentiate themselves by offering exceptional customer service, proactive threat response, and reliable cybersecurity solutions. Ensuring the reliability and efficacy of cybersecurity measures in safeguarding critical aviation assets and systems establishes trust and credibility among aviation stakeholders, positioning companies as dependable cybersecurity partners. Furthermore, regulatory compliance and adherence to industry standards shape market share positioning strategies within aviation cybersecurity. Companies that prioritize compliance with stringent aviation cybersecurity regulations and standards position themselves as reliable and trustworthy partners. Adhering to global aviation regulations and industry-specific cybersecurity protocols instills confidence in customers, demonstrating a commitment to meeting the highest security standards within the aviation industry. Environmental considerations, such as the impact of cybersecurity solutions on operational efficiency and system performance, also influence market positioning strategies. Companies that offer cybersecurity solutions designed to minimize disruptions to aviation operations while ensuring optimal system performance position themselves favorably within the market. Solutions that strike a balance between robust security measures and minimal impact on operational efficiency gain traction among aviation stakeholders seeking comprehensive cybersecurity without compromising operational effectiveness. Additionally, the ability to offer customizable and scalable cybersecurity solutions tailored to different segments of the aviation industry influences market share positioning. Companies that provide flexible cybersecurity offerings, adaptable to the diverse needs of airlines, airports, manufacturers, and service providers, gain a competitive edge. The capacity to customize solutions according to specific aviation requirements and scale them as per the evolving threat landscape enhances market positioning within the sector.

Leave a Comment