Market Trends

Key Emerging Trends in the Aviation Cyber Security Market

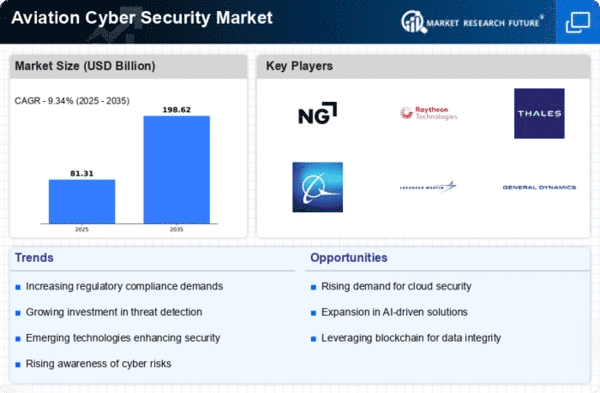

The aviation cybersecurity market is witnessing significant trends driven by technological advancements, evolving cyber threats, regulatory changes, and the increasing integration of digital solutions within the aviation sector. One prominent trend is the rising sophistication of cyber threats targeting the aviation industry. Cybercriminals continuously develop advanced attack methods, including ransomware, phishing, and malware attacks, exploiting vulnerabilities within aviation systems. This trend necessitates the development of more sophisticated and proactive cybersecurity solutions to counter these evolving threats effectively. Moreover, there's a growing emphasis on the convergence of cybersecurity and safety within aviation. Traditionally, aviation safety and cybersecurity were considered distinct domains, but the trend now aligns both aspects as interconnected elements crucial for overall aviation resilience. The integration of cybersecurity measures into safety protocols and systems is becoming essential to ensure the integrity and safety of critical aviation assets and operations. The rapid adoption of new technologies in aviation, such as IoT (Internet of Things), AI (Artificial Intelligence), and cloud computing, is another trend shaping aviation cybersecurity. While these technologies offer operational benefits, they also expand the attack surface for potential cyber threats. The trend involves integrating robust cybersecurity measures into these technologies to mitigate vulnerabilities and secure aviation networks effectively. Furthermore, the regulatory landscape is influencing trends within the aviation cybersecurity market. Aviation regulatory bodies worldwide are mandating stringent cybersecurity standards and compliance requirements to enhance the resilience of aviation systems against cyber threats. Compliance with regulations such as FAA (Federal Aviation Administration) guidelines, ICAO (International Civil Aviation Organization) standards, and industry-specific cybersecurity protocols is driving the adoption of cybersecurity solutions and practices across the aviation industry. The shift towards a proactive and risk-based approach to cybersecurity is also a notable trend in the aviation cybersecurity market. Companies are increasingly focusing on identifying and addressing vulnerabilities before they are exploited. This trend involves comprehensive risk assessments, threat intelligence analysis, and proactive measures to strengthen cybersecurity posture, ensuring a preemptive response to potential cyber threats. Additionally, there's a rising demand for cybersecurity solutions tailored specifically for the aviation sector. The aviation industry requires specialized cybersecurity solutions that address the unique challenges and complexities of aviation systems. This trend emphasizes the development of niche cybersecurity products and services designed explicitly for aircraft, aviation infrastructure, flight operations, and passenger data protection. The growing awareness and emphasis on cybersecurity training and education within the aviation workforce represent another significant trend. Airlines, aviation service providers, and manufacturers are investing in cybersecurity training programs to enhance the awareness and capabilities of their personnel. This trend aims to create a cybersecurity-aware culture within the aviation workforce, empowering employees to identify and respond effectively to cyber threats. Moreover, the trend of collaborative cybersecurity initiatives and information sharing among industry stakeholders is gaining momentum. Airlines, aviation authorities, cybersecurity firms, and government agencies are collaborating to establish information-sharing networks and collaborative platforms. These partnerships facilitate the sharing of threat intelligence, best practices, and cybersecurity insights to collectively combat cyber risks within the aviation ecosystem.

Leave a Comment