Rising Cyber Threats

The automotive cyber-security market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats targeting vehicles. As vehicles become more connected, the potential attack surface expands, making them attractive targets for cybercriminals. In 2025, it is estimated that cyber incidents in the automotive sector could lead to losses exceeding $3 billion. This alarming trend compels manufacturers and service providers to invest in robust cyber-security measures to protect their systems and customer data. The automotive cyber-security market is thus driven by the urgent need to mitigate risks associated with these threats, ensuring the safety and security of both vehicles and their occupants.

Consumer Awareness and Demand

Consumer awareness regarding cyber-security issues in vehicles is on the rise, significantly impacting the automotive cyber-security market. As more consumers become informed about potential vulnerabilities, they are increasingly demanding enhanced security features in their vehicles. Surveys indicate that approximately 70% of consumers consider cyber-security a critical factor when purchasing a new vehicle. This growing expectation drives manufacturers to prioritize cyber-security solutions, leading to increased investments in the automotive cyber-security market. Consequently, companies are focusing on developing advanced security technologies to meet consumer demands, thereby fostering a more secure automotive ecosystem.

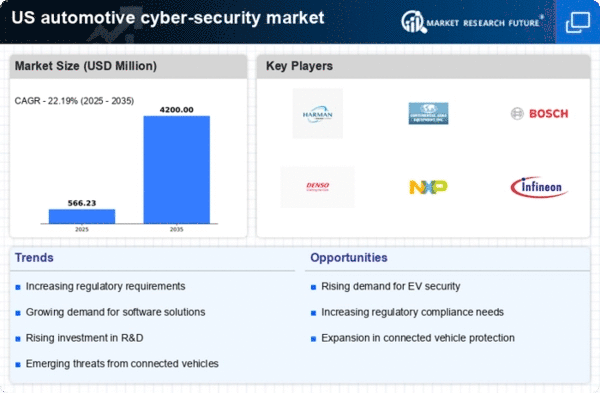

Regulatory Compliance Requirements

The automotive cyber-security market is significantly influenced by evolving regulatory compliance requirements aimed at enhancing vehicle security. In the US, regulatory bodies are increasingly mandating stringent cyber-security standards for automotive manufacturers. For instance, the National Highway Traffic Safety Administration (NHTSA) has proposed guidelines that require manufacturers to implement robust cyber-security measures. Compliance with these regulations is not only essential for legal adherence but also for maintaining consumer trust. As a result, the automotive cyber-security market is witnessing a surge in demand for solutions that help manufacturers meet these regulatory requirements, driving innovation and investment in the sector.

Collaboration Among Industry Players

Collaboration among various stakeholders in the automotive sector is emerging as a key driver for the automotive cyber-security market. Manufacturers, technology providers, and regulatory bodies are increasingly working together to develop comprehensive security frameworks. This collaborative approach facilitates the sharing of best practices and resources, ultimately enhancing the overall security posture of the automotive ecosystem. In 2025, it is anticipated that partnerships between automotive companies and cyber-security firms will lead to the development of innovative solutions, further propelling the automotive cyber-security market. Such collaborations are essential for addressing the complex challenges posed by cyber threats in an interconnected automotive landscape.

Technological Advancements in Vehicle Systems

The automotive cyber-security market is being propelled by rapid technological advancements in vehicle systems, particularly with the integration of connected and autonomous vehicles. These innovations necessitate sophisticated cyber-security measures to protect against potential vulnerabilities. In 2025, it is projected that the market for connected vehicles will reach $200 billion, underscoring the need for comprehensive security solutions. As manufacturers adopt advanced technologies such as AI and machine learning, the automotive cyber-security market must evolve to address new challenges. This dynamic environment encourages continuous investment in cyber-security solutions, ensuring that vehicles remain secure amidst technological progress.