Rising Cyber Threats

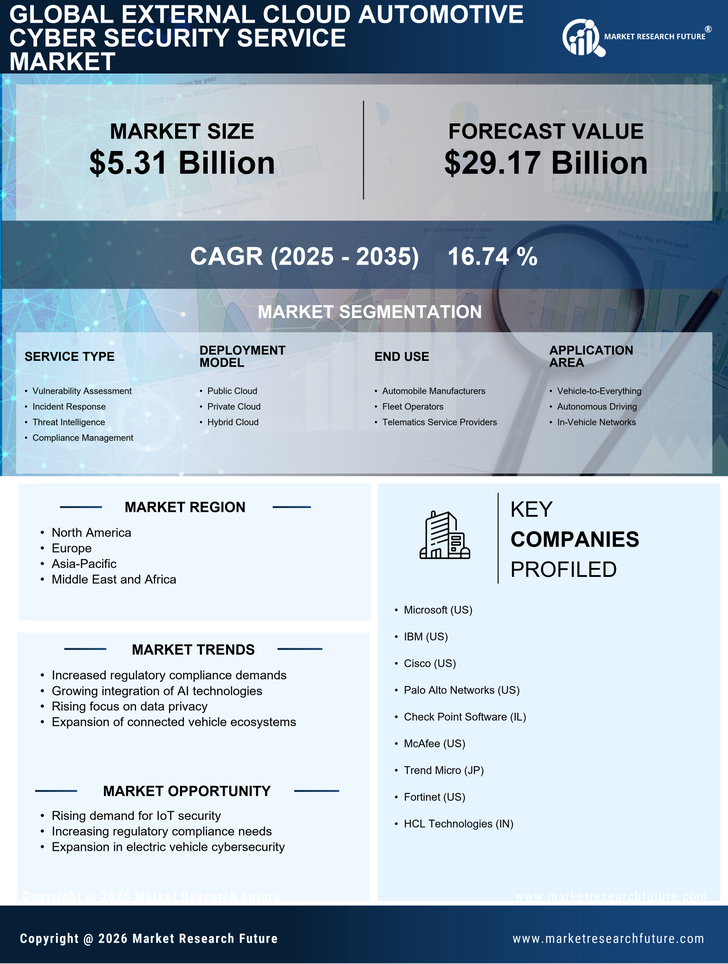

The External Cloud Automotive Cyber Security Service Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats targeting the automotive sector. As vehicles become more connected and reliant on software, the potential attack surface expands, making them attractive targets for cybercriminals. Reports indicate that the automotive industry has seen a notable rise in cyber incidents, prompting manufacturers to prioritize cybersecurity measures. This heightened awareness of vulnerabilities drives investments in external cloud cybersecurity services, as companies seek to protect sensitive data and ensure the safety of their vehicles. The urgency to mitigate risks associated with cyberattacks is likely to propel the growth of the External Cloud Automotive Cyber Security Service Market in the coming years.

Collaboration and Partnerships

The External Cloud Automotive Cyber Security Service Market is witnessing a trend of collaboration and partnerships among various stakeholders, including automotive manufacturers, technology providers, and cybersecurity firms. These collaborations aim to enhance the overall cybersecurity posture of vehicles by combining expertise and resources. By working together, companies can develop innovative solutions that address the unique challenges posed by cyber threats in the automotive sector. Industry reports suggest that strategic partnerships are becoming increasingly common as firms recognize the need for comprehensive cybersecurity strategies. This collaborative approach not only accelerates the development of effective cybersecurity solutions but also drives the adoption of external cloud services, thereby propelling the growth of the External Cloud Automotive Cyber Security Service Market.

Advancements in Cloud Technology

The External Cloud Automotive Cyber Security Service Market is benefiting from rapid advancements in cloud technology, which offer scalable and flexible solutions for cybersecurity. Cloud-based services provide automotive manufacturers with the ability to deploy security measures quickly and efficiently, adapting to the evolving threat landscape. The integration of advanced technologies such as artificial intelligence and machine learning into cloud services enhances threat detection and response capabilities. According to industry forecasts, the cloud security market is expected to grow significantly, with a substantial portion attributed to the automotive sector. This trend indicates that automotive companies are increasingly turning to external cloud cybersecurity services to leverage these technological advancements, thereby fostering growth in the External Cloud Automotive Cyber Security Service Market.

Consumer Demand for Vehicle Safety

The External Cloud Automotive Cyber Security Service Market is also driven by rising consumer demand for enhanced vehicle safety and security features. As consumers become more aware of cybersecurity risks associated with connected vehicles, they are increasingly prioritizing safety when making purchasing decisions. This shift in consumer behavior compels automotive manufacturers to invest in robust cybersecurity measures to protect their products and maintain customer loyalty. Surveys indicate that a significant percentage of consumers consider cybersecurity features as a critical factor in their vehicle selection process. Consequently, automotive companies are likely to seek external cloud cybersecurity services to meet these consumer expectations, thereby contributing to the growth of the External Cloud Automotive Cyber Security Service Market.

Regulatory Compliance Requirements

The External Cloud Automotive Cyber Security Service Market is significantly influenced by stringent regulatory compliance requirements imposed on automotive manufacturers. Governments and regulatory bodies are increasingly mandating that companies implement robust cybersecurity measures to protect consumer data and ensure vehicle safety. For instance, regulations such as the General Data Protection Regulation (GDPR) and various national cybersecurity frameworks necessitate that automotive firms adopt comprehensive cybersecurity strategies. Compliance with these regulations not only helps in avoiding hefty fines but also enhances consumer trust. As a result, automotive companies are likely to invest in external cloud cybersecurity services to meet these compliance standards, thereby driving the growth of the External Cloud Automotive Cyber Security Service Market.