Research Methodology on Automotive Cybersecurity Market

Abstract

This research aims at carrying out a comprehensive study of the Automotive Cybersecurity Market. To achieve this goal, an analysis of the market is conducted using qualitative and quantitative techniques. Credible sources such as secondary research, industry associations, and statistic databases are used to provide accurate and reliable data in order to give an informed view of the market’s current and future condition. The report provides an in-depth view of the Automotive Cybersecurity Market as well as its changing dynamics, structure, and competitive landscape.

Introduction

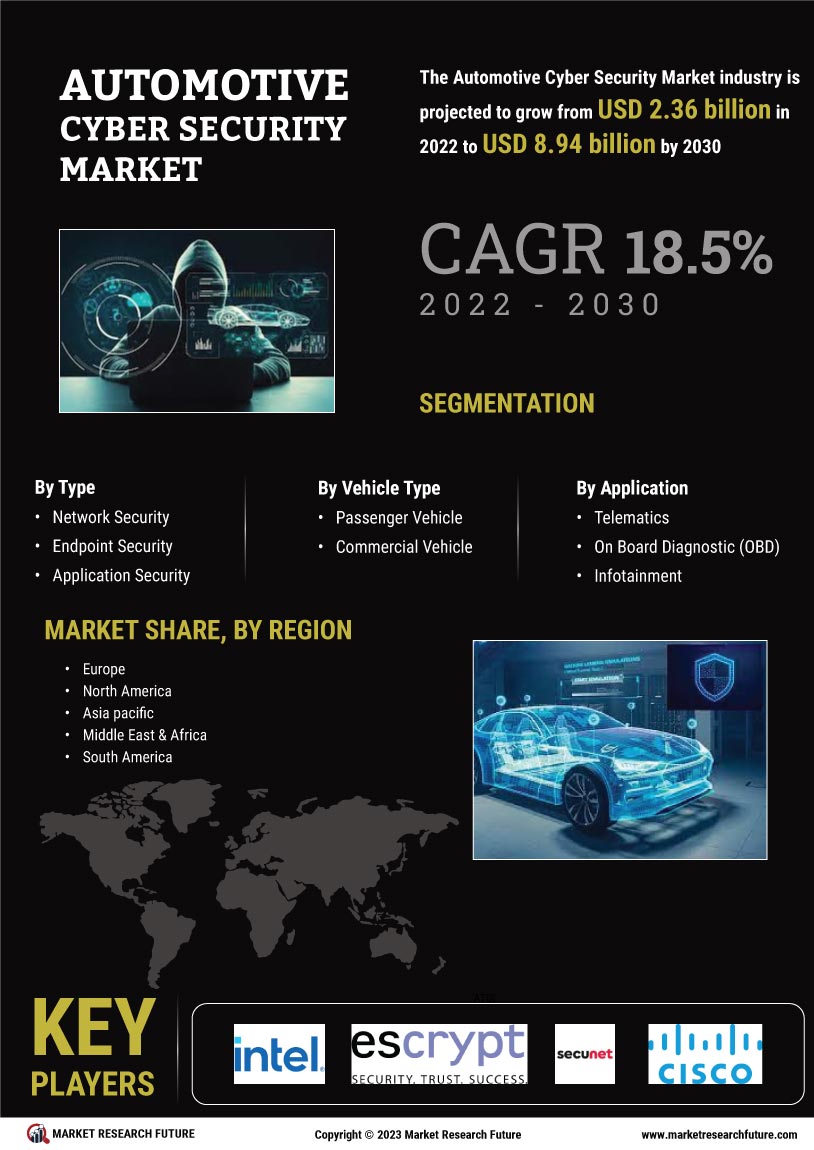

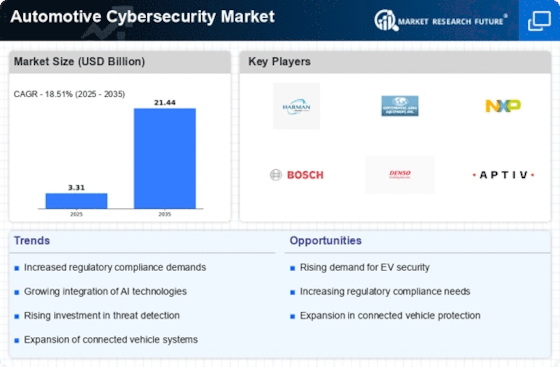

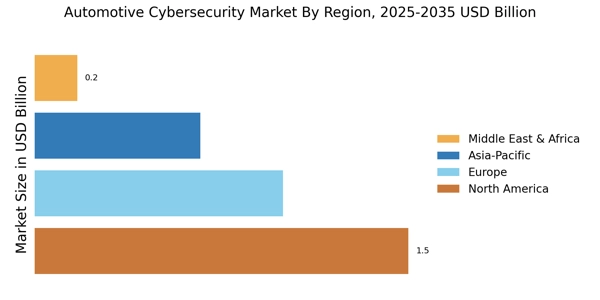

The automotive cybersecurity market is expected to register steady growth in the coming years due to the increasing adoption of connected and automated technologies in the automotive industry and the growing threat of cyberattacks. With the technological advancements in the automotive sector, the need for the deployment of cyber security solutions is increasing to protect against malicious attacks. The rising demand for connected cars and the need for secure connected vehicles are driving the growth of the automotive cybersecurity market.

Furthermore, governments across the world are implementing stringent regulations to mandate the deployment of cyber security solutions in vehicles to protect them against cyber threats. This report provides a detailed study of the market, with an in-depth analysis power of market dynamics, key market players, and a quantitative analysis of the market.

Research Methodology

The research methodology used for this study includes a desk review, survey design and programming, secondary research, and interviews, together with automation and harvesting of survey data. The methodology is outlined as follows.

Desk Review

A desk review of relevant literature and documents is undertaken to assess the market size and structure, identify challenges and opportunities and derive insights into the current and future state of the automotive cybersecurity market.

Survey Design and Programming

A survey is designed to collect data on the key challenges and opportunities in the Automotive Cybersecurity Market and to assess the response of existing and potential customers to the market. The survey is programmed and distributed through social media, such as Twitter and Reddit, to ensure a wide range of responses.

Secondary Research

Secondary research is conducted to identify and analyse current industry trends and market dynamics. Sources of information accessed include trade publications, automotive publications, industry reports, academic journals, and company websites.

Interviews

Interviews are conducted with key industry participants to collect insights into the automotive cybersecurity market from an expert perspective.

Automation and Harvesting of Survey Data

Data is collected through survey responses, automated and harvested for further analysis.

Analysis

The collected data is analysed to provide insights into the current and future state of the automotive cybersecurity market. Quantitative analysis is conducted to assess the size and trends of the market.

Conclusion

This research aims to provide a comprehensive study of the Automotive Cybersecurity Market. To achieve this goal, research methodologies are used that cover qualitative and quantitative techniques. Data is sourced from credible sources such as secondary research, industry associations, statistic databases and interviews with key industry participants. The collected data is analysed to provide insights into the current and future state of the market. This report aims to provide an in-depth view of the Automotive Cybersecurity Market as well as its changing dynamics, structure and competitive landscape.